When most people imagine trading, they think of constant action — screens full of charts, non-stop buying and selling, and algorithms firing trades 24/7. In reality, the most successful strategies do something very different: they spend most of their time waiting.

Waiting might not sound exciting, but in markets, it’s one of the strongest advantages a trader or algorithm can have.

Why Waiting Is an Edge

Markets Are Not Always Tradable

Markets move in phases. Sometimes they trend strongly, sometimes they go sideways, and sometimes they are just noisy. Trading in every condition is like playing every hand in poker — you might feel active, but your chances of winning shrink.

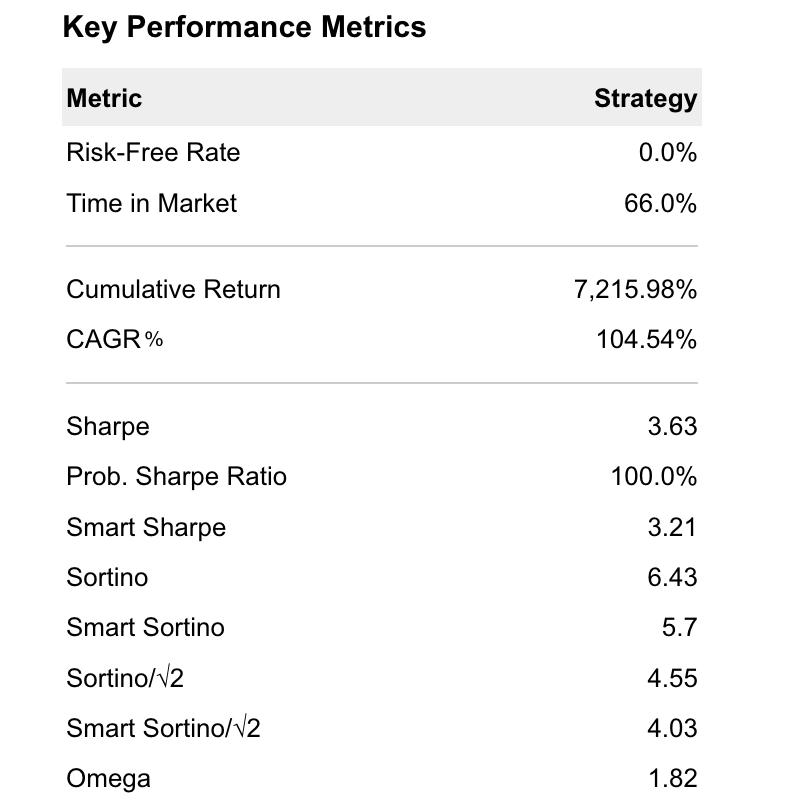

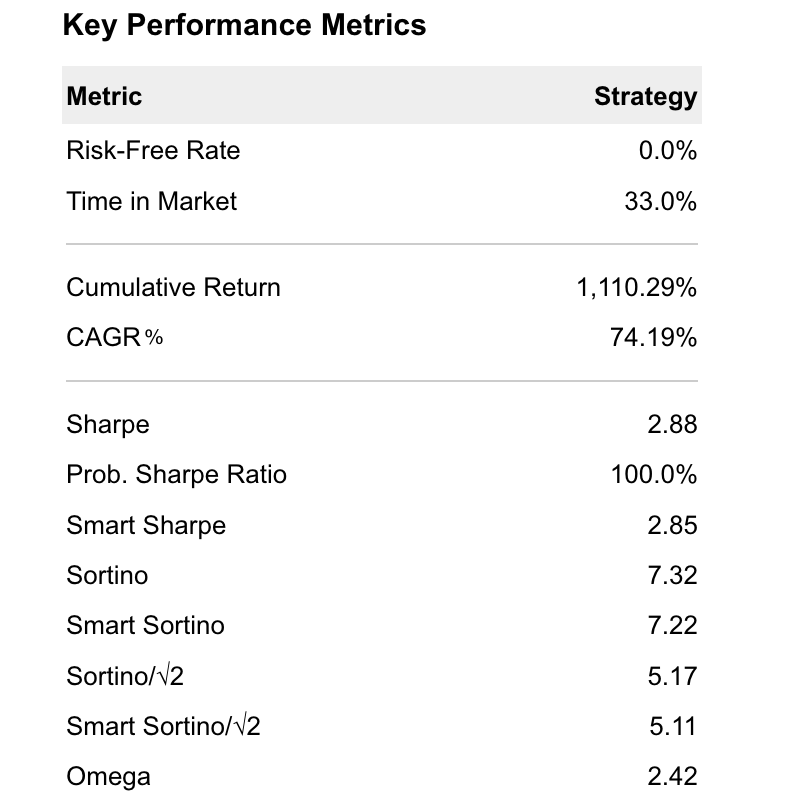

Overtrading Hurts Performance

Every trade costs money — spreads, fees, slippage. Trading constantly drains capital. In early 2025, Bitcoin spent months in a narrow $61k–$73k range. Many bots kept trading inside the chop and lost. Professional systems waited and captured the clean breakout to $84k.

Good Trades Are Rare

Profits in trading usually come from a small number of big moves. Waiting ensures that you save your capital and energy for those moments instead of wasting it on noise.

How Algorithms Decide to Wait

1. Volatility Check

If markets are too calm, profits don’t cover costs. If they’re too wild, risks are unmanageable. Algorithms measure volatility and act only when conditions are balanced.

2. Liquidity Check

Thin markets (like crypto weekends) can lead to bad fills and slippage. Many professional systems simply don’t trade when liquidity is low.

3. Market Regime

Algorithms classify whether the market is trending, ranging, or consolidating. If the setup doesn’t match the system’s strength, the algorithm does nothing.

Real-World Examples

- Bitcoin 2025: Instead of chasing every dip, professional systems stayed idle through sideways chop and only acted when volatility signaled a real breakout.

- Ethereum Layer-2 Tokens: In mid-2025, low liquidity made trading dangerous. Systems that waited avoided costly mistakes.

- FX Market: In April 2025, when the Bank of Japan surprised with policy changes, many retail traders jumped in and got burned. Algorithms that paused until volatility calmed captured better moves afterward.

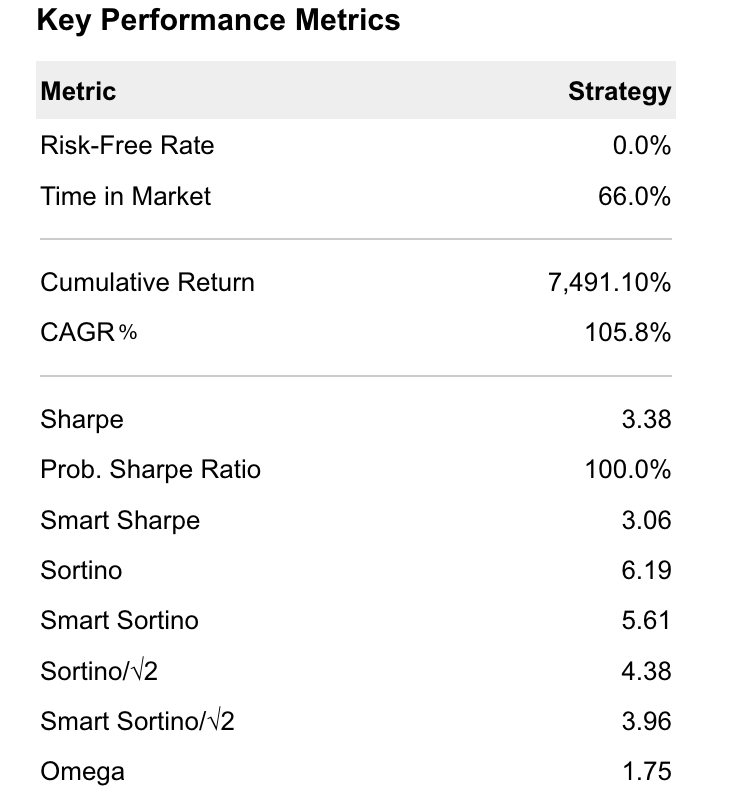

Why Patience Wins Long-Term

- Smaller Drawdowns: Waiting avoids unnecessary losses.

- Better Risk-Reward: Capital is used only when chances are best.

- Consistency: Long-term performance is smoother, which matters to both traders and investors.

Takeaways for Traders

- Don’t trade just to feel active.

- Add filters: volatility, liquidity, and market structure.

- Let your system sit idle if the setup isn’t there.

- Remember: sometimes the best trade is no trade.

Conclusion

The hidden power of trading is patience. Algorithms that trade constantly end up losing to costs and noise. The best ones filter, wait, and strike only when the odds are in their favor.

In trading, waiting is not laziness — it’s discipline. And discipline is what makes the difference between amateurs and professionals.