Private-Dynamic

Balanced multi-asset strategy based on BTC and ETH.

Inside the Strategy

Private Dynamic is an automated strategy based on our core trend-following portfolio, enhanced with a dynamic position sizing mechanism designed for retail investors who prefer smoother equity curves and faster recovery from drawdowns.

The strategy operates via API directly on the client’s exchange account — no funds are transferred or managed by third parties, and full control remains with the user.

The model uses a capital allocation system that adjusts position size based on recent outcomes.

If a trade closes at a loss, the next trade’s volume is automatically doubled.

If two losses occur consecutively, the volume is quadrupled.

This logic helps reduce drawdown periods and improve recovery speed compared to traditional trend-based systems.

The trading algorithms are specifically tailored for this model:

Take-profits are shorter,

Position sizing adapts to volatility,

Entry signals are optimized for responsiveness.

This results in sharp equity curve moves, often described as “bursts,” where clusters of small trades can produce meaningful gains.

The strategy avoids averaging or mean-reversion logic — each trade is fully risk-managed with predefined exit rules.

It performs best in moderately volatile markets, where other models may remain inactive or underperform.

During strong trends, it may exit early and miss full moves — a deliberate design choice to maintain stability.

Private Dynamic was built using real-world trading frameworks and was further tested on historical data across multiple market phases.

Since early 2021, the model has been used actively in a tracked portfolio. The core objective is to deliver consistent and confident results without requiring manual intervention or custody of capital.

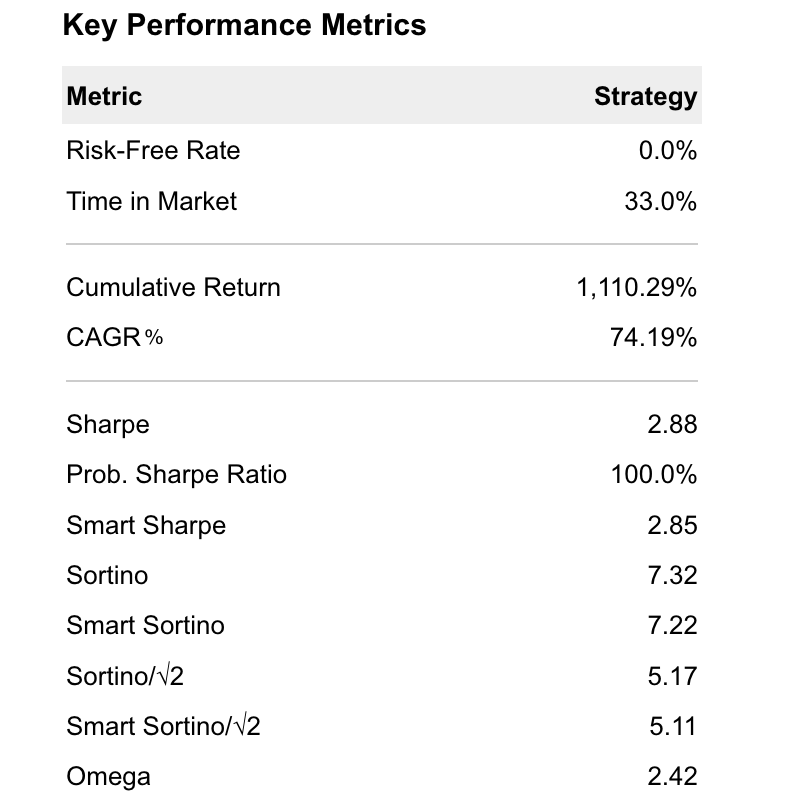

What Could’ve Happened If You Had Used the Strategy Since Early 2019?

Based on historical simulations of the Private Dinamic strategy with different risk levels,

the table below shows how a $10,000 account could have grown — assuming a start date of January 2021 with no withdrawals.

| Risk Level | Total Return | Final Value |

|---|---|---|

| x1 | +1,110% | $121,000 |

| x2 | +2,220% | $232,000 |

| x3 | +3,330% | $343,000 |

| x4 | +4,440% | $454,000 |

Fees & Conditions

Minimum investment: $5,000

Connection fee: $1000

Supported currencies: USDT / BTC / ETH

Success Fee: 30% of net profit — only if profit is made

Early disconnection: free of charge

Private-Dynamic Details:

- Total Return (4Y): 1110%

- Risk Level: Low

- Average Monthly Return: 4.93%

- Max drawdown per day: -10.28%

- Maximum drawdown: -13.15%

solutions

Strategic Models for Independent Users

Aquila Private’s algorithmic models are built for data transparency and user-managed execution — combining smart analytics, risk filters, and real-time integration.

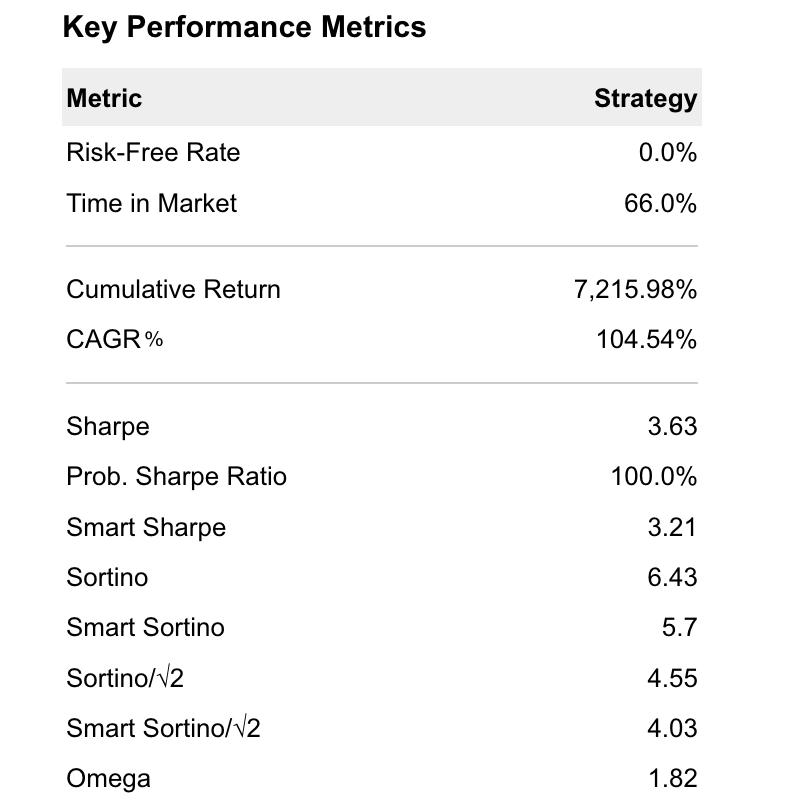

Private Basket-70

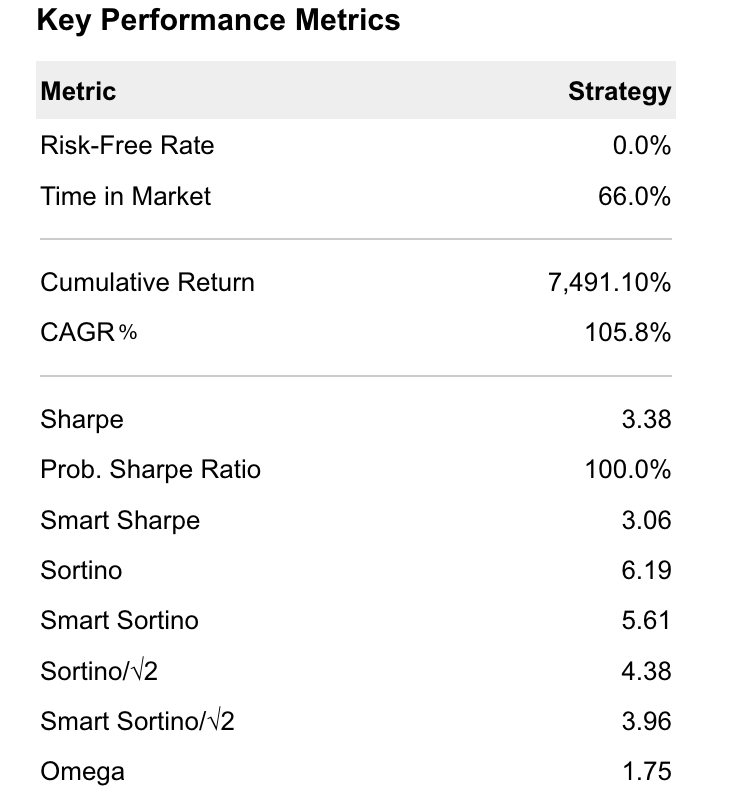

- Total Return (5Y): 7215%

- Risk Level: Elevated

- Average Monthly Return: 7.51%

- Max drawdown per day: -14.58%

- Maximum drawdown: -19.98%

Private-Dynamic

- Total Return (4Y): 1110%

- Risk Level: Low

- Average Monthly Return: 4.93%

- Max drawdown per day: -10.28%

- Maximum drawdown: -13.15%

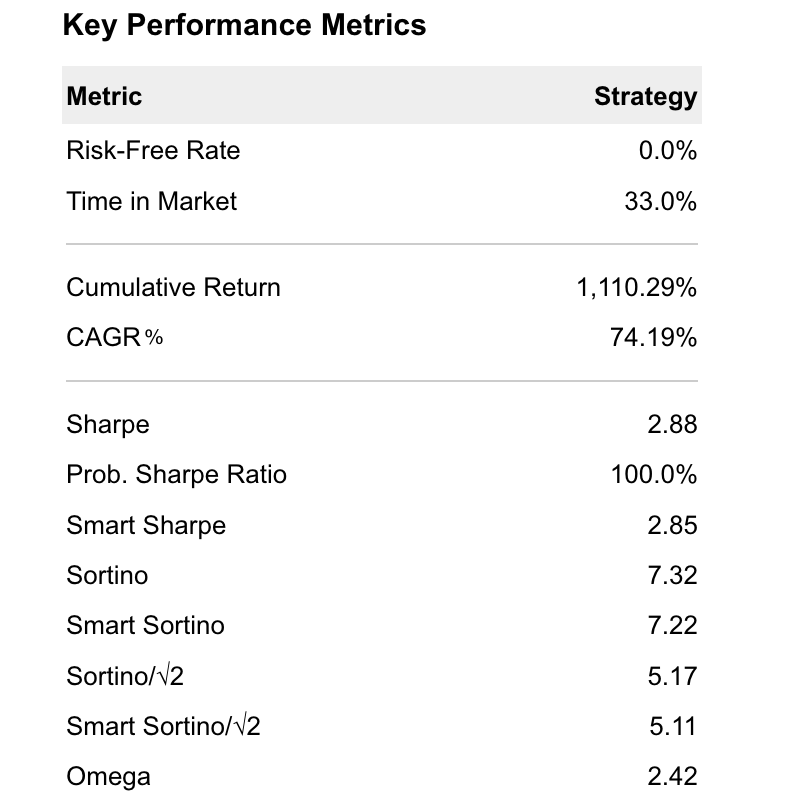

Private Basket-50

- Total Return (5Y): 7491%

- Risk Level: Moderate

- Average Monthly Return: 5.15%

- Max drawdown per day: -14.58%

- Maximum drawdown: -19.99%

Early testing shows promising historical consistency. These strategies will become available through your Aquila Private account soon.

* All performance data reflects historical model behavior. No guarantees. Not investment advice.

Where Private Users Explore Institutional Tools

Access algorithmic models through the same technical interface used by professional participants — fully non-custodial and under your control.

news

Financial Reviews & Market Insights

Stay ahead with expert analysis and curated updates from the crypto and macro world.

faq

Support & Guidance You Can Trust

Your funds remain in your personal exchange account. Connection is established via read-only API or supported third-party platforms. We never have access to your assets, and no withdrawals are possible through our systems.

Yes. Our team provides full onboarding support. You don’t need prior trading knowledge — the connection is simple and guided.

We offer a subscription model starting at 100 USDT. It includes access to strategy connectors, analytics, and updates. Payment is made in cryptocurrency.

Our system supports major exchanges like Binance, OKX, Bybit, Bitget, and KuCoin. Strategies are mirrored to your account automatically — no asset custody is involved.

Your funds and any trading results remain in your exchange account. You can withdraw at any time directly from the exchange — we do not hold or restrict access.

Based on historical simulations, individual strategies have shown annualized performance ranging from 75% to over 247%, depending on market conditions and selected risk levels. These results reflect past model behavior only and do not guarantee future returns. Use this data for informational and analytical purposes only.

We offer access through a revenue-sharing model. Our infrastructure enables wider usage while aligning incentives — we only earn when performance is delivered.

Contacts

Get in Touch

We’re here to support you at every step. Whether you have questions about the platform or need help getting started, our team is available to assist you.

IT Development address (UK):

- Aquila Private LTD

- 14174, 182–184 High Street North East Ham, London, E6 2JA, UK

Marketing Office (USA):

- Aquila Private LLC

- 2125 Biscayne Blvd, Ste 204 #21573 Miami, FL 33137, USA

- (non-client office — no financial services provided)

General inquiries:

Trust Results, Not Promises

With Aquila Private, your capital remains fully under your control while our interface helps connect you to algorithmic models. We provide access — decisions and outcomes are always in your hands.