Risk Management in Algorithmic Trading: Strategies to Protect Capital and Maximize Returns

Introduction

Why Risk Management is the Cornerstone of Quantitative and Algorithmic Trading

Professional investors don’t get derailed by unpredictable markets — they’re prepared for them. In the world of algorithmic trading, where milliseconds and model assumptions drive execution, risk management isn’t an afterthought. It’s the foundation.

Today’s markets are volatile, fragmented, and driven by a confluence of human and machine interaction. This makes the role of risk management increasingly technical and more relevant than ever. It’s no longer about simply setting stop-losses or avoiding downside; it’s about building systems that can self-assess, readjust, and protect capital dynamically without deviating from the original strategy intent.

Consider a multi-strategy fund connecting its exchange account to algo strategies via secure APIs like those through Aquila Private. The underlying protocol permits capital to remain in custody while giving algos full trading access. Now ask yourself: Would you let that strategy run 24/7 during volatile macro events without embedded capital protection logic? Of course not. That’s where risk management mechanisms — like conditional VaR, latency-aware stopouts, and portfolio-level exposure caps — come into play.

In quantitative systems, risk controls don’t just protect — they enable scale. Without them, firms can’t responsibly allocate institutional capital or onboard external mandates. Effective risk structures are what allows strategies to compound over time amidst drawdowns, fat-tails, and black swan events.

What Happens When Risk Management Is Missing?

Ignore risk management in algo trading, and the consequences aren’t hypothetical — they’re statistical inevitabilities.

Take the example of an over-optimized backtest. The strategy looks flawless on paper: consistent returns, low volatility, all green flags. But once deployed live — exposed to unknown market microstructure, tail events, and data lags — it collapses under pressure. Why? Often because the strategy was fit to past data without honoring the current market’s shape, regime changes, or structural shifts.

Another recurring issue: leverage misuse. Even a 2:1 leverage ratio can prove lethal if applied to a high-volatility asset during a low-liquidity window. Institutional investors managing real capital understand this. They don’t want to ride the highs of a strategy only to be wiped out in a single tail event.

And emotional override in algo-driven portfolios? It may sound paradoxical, but it happens: when drawdowns occur, some traders intervene manually. This divergence derails systematic edges.

— So, can a strategy survive without engineered risk controls?

— Yes, but only until mean reversion fails… and it usually fails exactly when it matters most.

That’s why risk is not merely the downside of return — it’s the cost of staying in the game.

Core Principles of Risk Management

Understanding the Risk–Return Equation in Algorithmic Systems

Every basis point of return in algorithmic trading has a corresponding unit of risk. The sophistication lies in knowing whether that risk is systematic, idiosyncratic, regime-based, or the result of liquidity clustering.

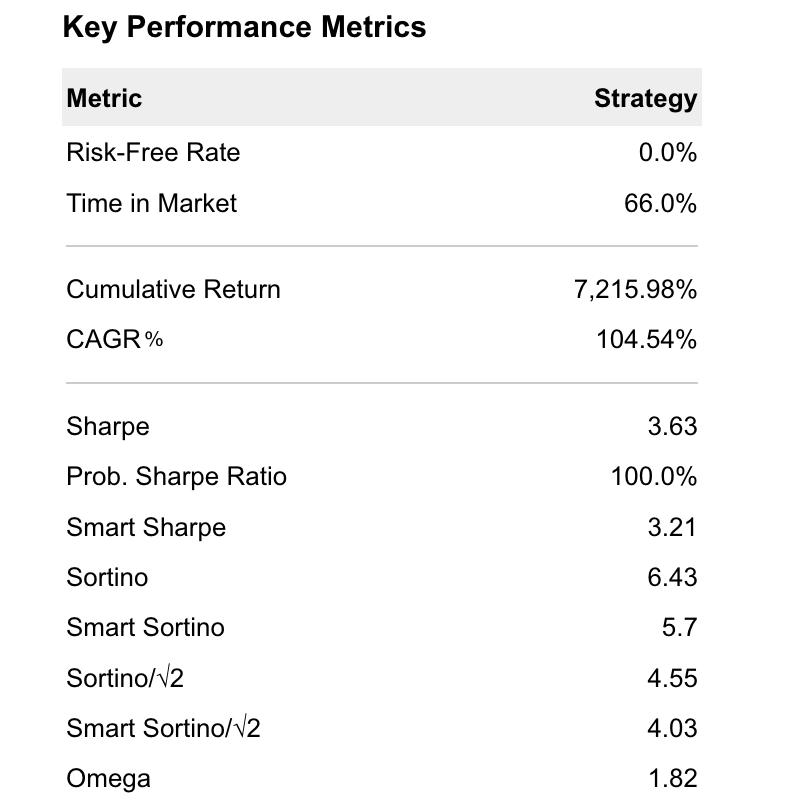

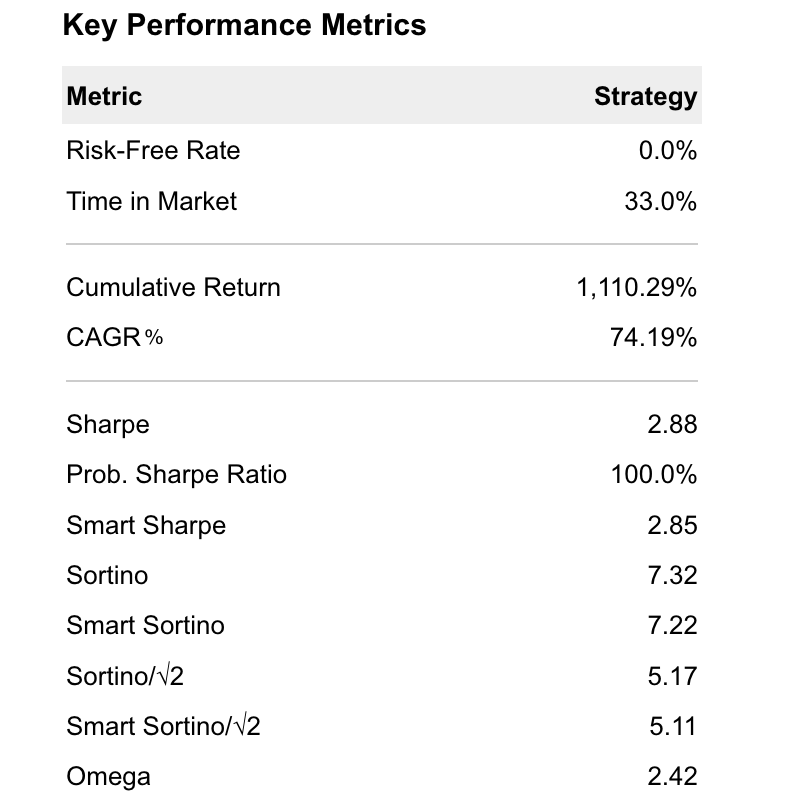

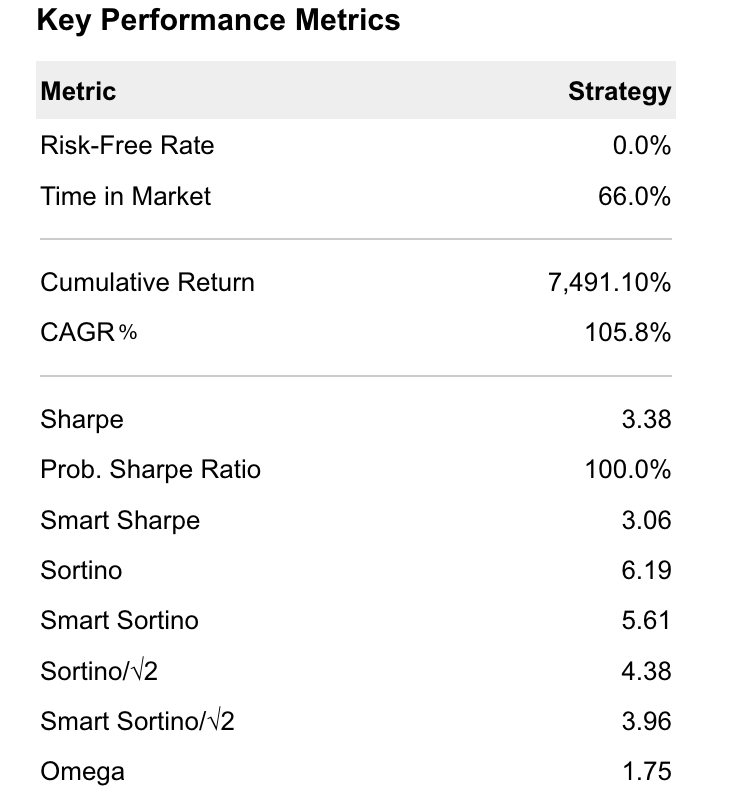

High-net-worth investors increasingly evaluate strategies not just by Sharpe or Sortino ratios, but by how risk is sourced and recycled within the model. Is the strategy taking directional risk, funding risk, event risk, or volatility harvesting? How does this align with portfolio-level exposures?

Aquila Private provides a rare window here. Investors can follow strategies via API — without moving capital. They observe return streams and the accompanying risk metrics: rolling drawdowns, margin utilization, exposure decay. This kind of transparency arms allocators with the clarity they need to size positions intelligently and rebalance exposures proactively.

Risk is not inherently bad. A strategy long volatility during a macro event may operate at a 20% daily VaR — and still be crucial to institutional hedging frameworks. But unmanaged risk? That’s a career-breaker.

Defining and Enforcing Drawdown Limits

Defining a drawdown cap is like setting a circuit breaker on capital loss. For absolute return strategies, it’s not just a target — it’s a throttle.

Institutional mandates often include maximum drawdown limits of -15% or less on a rolling 30-day basis. But in algorithmic trading, you’re better served by dynamic drawdown buffers: limits that adapt based on volatility, trade frequency, and system behavior.

With Aquila-connected strategies, capital remains on-client exchange accounts — but drawdown logic is executed server-side. That means real-time cessation of trading when breach levels are hit, even if the market is accelerating. This autonomy protects clients from behavioral panic and gives space to reassess without capital displacement.

Moreover, historical PnL variance data can shape these limits: a momentum strategy running fine at -8% can become unsustainable at -12% under stressed conditions. Designing adaptive drawdown ceilings helps ensure consistency across market regimes.

Precision in Position Sizing and Intelligent Leverage

How much should you risk on any single position? The answer isn’t static — it’s contextual.

Position size must reflect multiple variables: strategy edge, volatility of the traded asset, available capital float, current leverage exposure, and portfolio correlation. A position that fits within a mean-reversion strategy’s parameters could be reckless if applied to a breakout trend model.

Through Aquila Private’s infrastructure, institutional users can control API-based allocation logic granularly. Whether allocating 0.5% of AUM per signal or adjusting margin per execution cycle, the game is to ensure no single trade — or sequence of losses — destabilizes the system.

On leverage: it multiplies not only return but also error. Smart leverage is not about borrowing against balance sheets; it’s about controlling gearing in relation to market risk conditions. Especially in crypto, where 20x leverage is often tempting but rarely sustainable, discipline in leverage capping can be the only difference between compounders and liquidations.

Quantitative Models for Risk Control

Value at Risk (VaR) and Conditional VaR: Measuring Exposure in 3D

VaR isn’t just a bank compliance metric anymore. In algorithmic trading, it’s a live, dynamic signal of capital at risk.

A 10-day 95% VaR tells you: under normal market conditions, the portfolio shouldn’t lose more than $X with 95% confidence. But more sophisticated traders focus on Conditional VaR (or Expected Shortfall): what happens when that 5% tail strikes?

Working with Aquila Private, investors can subscribe to strategies whose VaR-adjusted exposure dynamically throttles down during volatility bursts or high-skew sessions. This prevents blind allocation during periods with asymmetric downside.

More than a stat, VaR becomes part of signal integrity: if your strategy’s VaR doubles while returns plateau, that’s a red flag — either the edge is degrading or market shape has evolved.

Stress Testing and Scenario Modeling: Preparing for the Non-Normal

Modern markets break expectations regularly. So if your models are built around ‘average’ behavior, they’ll fail where it matters most — in non-linear drawdowns.

Stress testing builds resilience early by asking uncomfortable questions:

— What happens if BTC drops 30% overnight?

— How does the strategy react if spreads widen 400bps within 3 minutes?

— What if Binance API is delayed for 7 seconds during a Fed announcement?

Serious investors run these simulations continuously. Smart systems even introduce random latency into model tests, simulating slippage and misexecution to see whether the strategy still adheres to core logic.

By pre-experiencing trauma through simulation, you bulletproof execution during real-time spikes. Stress modeling becomes the firewall between theoretical risk and capital destruction.

Monte Carlo Simulations: The Probabilistic Lens on Strategy Viability

Monte Carlo models take your trading logic, add noise, and re-run it through thousands of randomized price paths. It’s not to see what happens on ‘average’ — but to explore the edge cases.

Used properly, Monte Carlo shows you the probability distribution of outcomes — where disaster might hide, or when outperformance clusters. If your max drawdown under worst-case scenarios jumps from -10% to -30%, you know how fast your assumptions can fail.

Aquila-based strategies often run pre-deployment simulations across volatility clusters to model “early-stage risk.” For example: if a new breakout strategy fails under low-liquidity ETFs, you sideline it before it burns real capital.

Monte Carlo is where intellectual honesty meets strategy resilience.

Portfolio Diversification Techniques

Strategic Cross-Asset Allocation in Algorithmic Frameworks

Diversification isn’t about spreading thin — it’s about layering uncorrelated risk.

In algorithmic portfolios, cross-asset allocation can mean combining a long-short crypto strategy with short-volatility equities, or a FX mean-reversion model with a DeFi swap arbitrage algo. The key isn’t the number of assets — it’s the independence of their return engines.

Clients using Aquila Private often cluster complementary systems across exchanges, sectors (crypto, equity, index), or temporal behavior (high-frequency vs. swing). The goal? Reduce portfolio heat spots. Let strong strategies carry exposure while weaker ones revert — all without liquidity choke points.

Diversification, done right, dampens volatility without capping upside. And in unstable markets, that composure is the real yield.

Hedging Exposure Via Correlated and Inverse Instruments

Smart algorithms hedge. Smarter investors force them to do it efficiently.

Inverse ETFs, correlated cross-pairs, on-chain option overlays — these instruments can act as defense layers without static capital locks. The most sophisticated algo teams employ “rolling hedges”: systems that auto-adjust protection levels based on volatility spikes, correlations breaking down, or liquidity shocks.

One Aquila-connected fund built a BTC/ETH delta-neutral position, while executing a separate strategy long on MATIC volatility. When ETH decoupled from BTC, the system reduced exposure to preserve beta-parity — fully automated.

This kind of real-time orthogonal hedging isn’t experimental — it’s best practice when managing capital at scale.

Operational Risk and Infrastructure Security

Ensuring Data Fidelity and Minimizing Latency Risk

You can’t trade what you can’t see — or what you see too slowly.

Operational risk often boils down to data fragility: price feeds that lag, oracles that fail, latency blindspots. An algorithm that processes data 300 milliseconds too late in a fast-moving market is effectively blind.

High-fidelity datasets must include backup providers, real-time latency monitoring, and event-context parsing. Through Aquila Private, data pipelines are audited for time drift and synchronized feed behavior, especially vital for high-frequency strategies.

The rule is simple: you’re only as good as your data clock. And for institutional money, even microseconds matter.

Redundancy Protocols: Preventing System Downtime

Trading stops, funds don’t. That’s why architecture must always include hot failovers and operational handoffs.

Well-architected systems include containerized nodes, swap-out data feeds, and execution fallback plans when API endpoints either rate-limit or crash. On centralized exchanges, this might mean redirecting orders to alternate liquidity venues; for DeFi, it could mean rebalancing across stablecoin protocols in seconds.

Redundancy isn’t just an IT problem — it’s a capital preservation mechanism. One major drawdown event can come from a singular system dependency failing at the wrong moment.

Institutionally aligned infrastructure assumes this upfront — because once confidence is lost, mandates disappear faster than market depth.

Conclusion

Why Sustainable Risk Practices Unlock Asymmetric Returns

Anyone can survive bull markets. Very few survive sideways markets without burning capital. Fewer still thrive during drawdowns.

The goal of modern algorithmic risk management isn’t simply to minimize losses — it’s to enable intelligent risk-taking. With tools like conditional drawdown ceilings, probabilistic simulations, and real-time hedging frameworks, intelligent investors don’t shy from volatility. They shape it.

Through Aquila Private and similarly structured platforms, allocators don’t have to relinquish fund custody or accept static products. They select on-chain or centralized strategies, connect via secure APIs, and receive both autonomy and transparency — with risk buffers embedded in every transaction.

In a landscape increasingly defined by real-time change, complexity is the constant. Risk management isn’t a shield — it’s the compass. Without it, even brilliant strategies get lost. With it, capital not only survives — it compounds.