Traditional trading relies heavily on technical and fundamental analysis. Charts, moving averages, RSI, earnings reports, and macroeconomic data have long been the backbone of decision-making. But in cryptocurrency markets, an entirely new layer of information is available — on-chain metrics.

Unlike traditional markets, where data about investor flows is opaque, blockchains are transparent by design. Every transaction, wallet movement, and smart contract interaction is recorded in real time. This creates a unique opportunity: traders and algorithms can analyze blockchain activity directly to gain insights into investor behavior, liquidity shifts, and potential price movements.

In recent years, on-chain analytics has evolved from a niche discipline into a core component of professional crypto trading. Algorithmic strategies that integrate on-chain signals with technical indicators have shown improved predictive power and resilience compared to those relying solely on price action.

What Are On-Chain Metrics?

On-chain metrics are data points derived from the public blockchain ledger. They measure the activity, distribution, and flow of assets within a blockchain ecosystem.

Broadly, on-chain metrics fall into three categories:

- Network Activity Metrics — track how many addresses and transactions are active.

- Liquidity and Flow Metrics — monitor how tokens move between wallets, exchanges, and protocols.

- Investor Behavior Metrics — assess how long coins are held, who is selling or accumulating, and at what profit/loss.

Examples of On-Chain Metrics

- Active Addresses: The number of unique addresses transacting in a given period. Rising active addresses often indicate increasing adoption or hype.

- Transaction Volume: Total value transferred on-chain. Sharp increases may precede volatility.

- Exchange Inflows/Outflows: If more coins move onto exchanges, selling pressure may be imminent. Conversely, outflows to cold storage often suggest accumulation.

- MVRV Ratio (Market Value to Realized Value): Measures whether the market is over- or undervalued relative to the average cost basis of holders.

- SOPR (Spent Output Profit Ratio): Indicates whether coins moved on-chain are being sold at a profit (>1) or loss (<1).

- HODL Waves: Visualize the age distribution of coins held. Long-term holders accumulating often precedes bullish moves.

Why On-Chain Data Complements Technical Analysis

Technical analysis (TA) focuses on price action — the end result of supply and demand. On-chain metrics go one level deeper, showing the flows that drive price action.

For example:

- TA may show Bitcoin is at resistance.

- On-chain metrics may reveal that long-term holders are accumulating, reducing sell pressure.

- Together, this provides a more complete picture.

This combination bridges the gap between what the market is doing (price) and why it is doing it (behavior).

Historical Context

On-chain analysis gained traction during Bitcoin’s early cycles. Researchers noticed that certain wallet behaviors correlated with price peaks and bottoms. For instance, high inflows to exchanges often aligned with local tops, while rising HODL activity often preceded long-term rallies.

As the crypto market matured, firms like Glassnode, CryptoQuant, and IntoTheBlock developed advanced on-chain analytics platforms. Today, hedge funds, algorithmic trading desks, and even traditional institutions integrating crypto exposure consider on-chain data essential for risk management and strategy design.

Key On-Chain Metrics and Their Role in Algorithmic Trading

Active Addresses and Network Growth

The number of active addresses is one of the simplest yet most powerful indicators of blockchain adoption and activity. A growing number of unique active addresses usually suggests rising interest and participation in the network. For algorithmic trading systems, increases in active addresses can be treated as a leading indicator of demand. For instance, during Bitcoin’s bull run in 2017, the number of active addresses rose sharply months before prices peaked, offering early signs of overheating in network usage.

Transaction Volume and Value Settled

Transaction volume measures the total amount of cryptocurrency transferred on-chain within a given timeframe. Sustained increases in transaction volume often precede periods of higher price volatility. Algorithms can monitor deviations from historical averages to identify when unusual amounts of capital are moving, signaling potential trend formation. Ethereum’s growth in 2020–2021, during the DeFi boom, was accompanied by a surge in transaction volume that aligned with rapid price appreciation.

Exchange Inflows and Outflows

One of the most actionable on-chain signals for short-term trading is the flow of coins into and out of centralized exchanges. When large amounts of Bitcoin or Ethereum move onto exchanges, it often signals upcoming sell pressure, as traders prepare to liquidate. Conversely, when funds move from exchanges to cold wallets, it suggests long-term accumulation. Algorithms can track these flows in real time, adjusting long/short exposure accordingly. For example, during the May 2021 crypto crash, massive inflows to exchanges preceded the sharp downturn, giving algorithms that monitored flows a clear warning signal.

MVRV Ratio (Market Value to Realized Value)

The MVRV ratio compares the current market capitalization of a cryptocurrency to its “realized capitalization,” which is calculated based on the price at which each coin last moved on-chain. High MVRV values suggest that most investors are sitting on profits, increasing the likelihood of profit-taking and sell-offs. Low MVRV values indicate that many investors are at a loss, which historically aligns with market bottoms. For algorithmic systems, MVRV provides a valuable filter to adjust exposure. A high MVRV might trigger reduced long exposure or hedging, while a low MVRV could justify accumulation strategies.

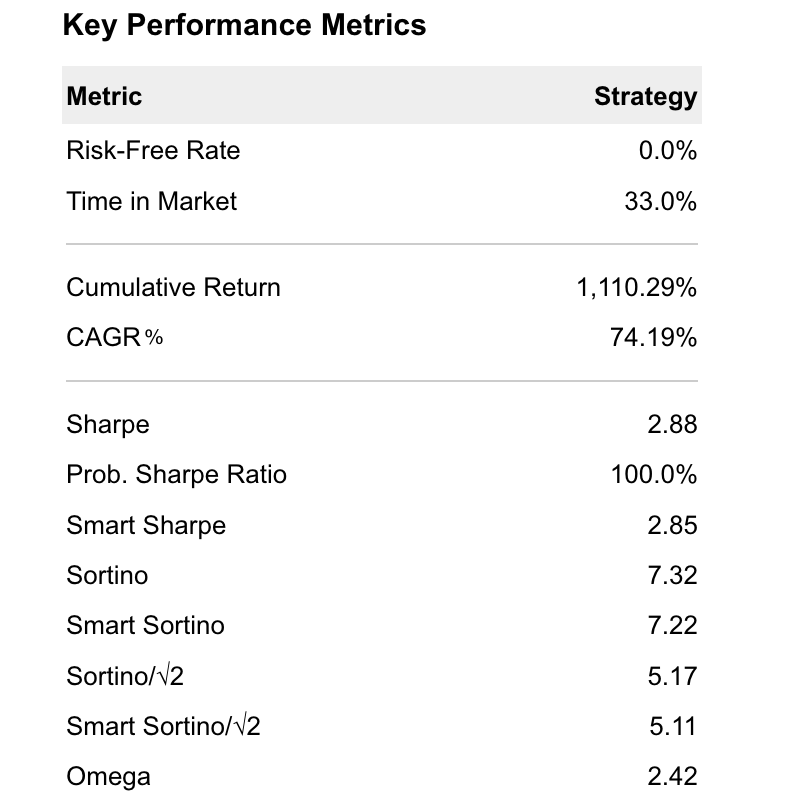

SOPR (Spent Output Profit Ratio)

SOPR measures whether the coins moved on-chain are being sold at a profit (SOPR > 1) or a loss (SOPR < 1). A rising SOPR indicates that traders are realizing profits, often near market tops. A falling SOPR shows capitulation, often near market bottoms. Algorithms can use SOPR trends as confirmation signals for momentum or mean reversion strategies. For instance, when SOPR falls below 1 and then rebounds, it has historically marked strong bullish reversals for Bitcoin.

HODL Waves and Coin Age Distribution

HODL Waves show the age distribution of coins held in wallets, visualizing how long coins remain dormant before moving. A growing share of old coins (long-term holders) typically indicates conviction and accumulation, reducing selling pressure. Conversely, when long-term holders start distributing coins, it often signals a market top. For algorithms, shifts in HODL Waves can be used as macro filters, strengthening the conviction of trend-following systems or alerting mean reversion models of incoming regime shifts.

Whale Activity and Large Transactions

On-chain data allows tracking of large holders, or “whales,” by monitoring wallets with significant balances. Whale movements often precede big market moves, as their trades have outsized impact on liquidity. Algorithms can detect clusters of large transfers as precursors to volatility. For example, in March 2020, significant Bitcoin inflows from whale addresses to exchanges occurred just before the COVID-driven crash, signaling upcoming turbulence.

How Algorithms Integrate On-Chain Metrics into Trading Systems

On-Chain as a Signal Filter

Most algorithmic trading systems already rely on technical indicators such as moving averages, RSI, or volatility measures. On-chain metrics are often used as additional filters to strengthen or weaken trade signals. For example, a momentum system may detect a bullish breakout in Bitcoin’s price, but if exchange inflows are simultaneously spiking, the algorithm can downweight or reject the trade, anticipating sell pressure. Conversely, if outflows dominate, the algorithm can increase position size, aligning with accumulation.

Threshold Triggers for Automated Decisions

Some algorithms use fixed thresholds in on-chain metrics to trigger entries or exits. For instance:

- If MVRV exceeds 3.0, reduce long exposure or hedge positions.

- If SOPR falls below 1.0 for multiple days, consider accumulation.

- If exchange inflows exceed a historical standard deviation threshold, reduce exposure. These rules transform on-chain data into actionable triggers for systematic trading.

Dynamic Position Sizing

Algorithms can scale position sizes based on the strength of on-chain signals. For example, if HODL Waves show strong accumulation from long-term holders, the system might allocate more capital to long positions. If whale activity signals heavy selling, the algorithm reduces exposure or shifts to defensive strategies.

Volatility Anticipation

On-chain flows often foreshadow volatility. When transaction volume and exchange flows surge, it indicates that liquidity is about to shift. Algorithms can switch from range-bound mean reversion models to breakout or trend-following systems when clustering of activity appears on-chain. This adaptability improves performance during regime shifts.

Machine Learning Integration

Machine learning models enhance the use of on-chain metrics by combining multiple variables into predictive frameworks. For example:

- Classification models (random forests, gradient boosting) can classify market states (bullish, bearish, neutral) based on on-chain features such as active addresses, SOPR, and exchange flows.

- Neural networks can capture non-linear relationships between on-chain metrics and price movements, often outperforming linear statistical models.

- Reinforcement learning agents can dynamically allocate capital between strategies depending on on-chain conditions, optimizing reward by reacting to shifts in network behavior.

Cross-Market Applications

On-chain metrics can also be used as leading indicators for correlated assets. For instance, large Bitcoin inflows to exchanges often trigger volatility in altcoins as liquidity cascades across the crypto market. Algorithms monitoring these flows can anticipate broader market turbulence and adjust multi-asset portfolios accordingly.

Case Studies: When On-Chain Metrics Gave Early Signals

Bitcoin 2017 Bull Run

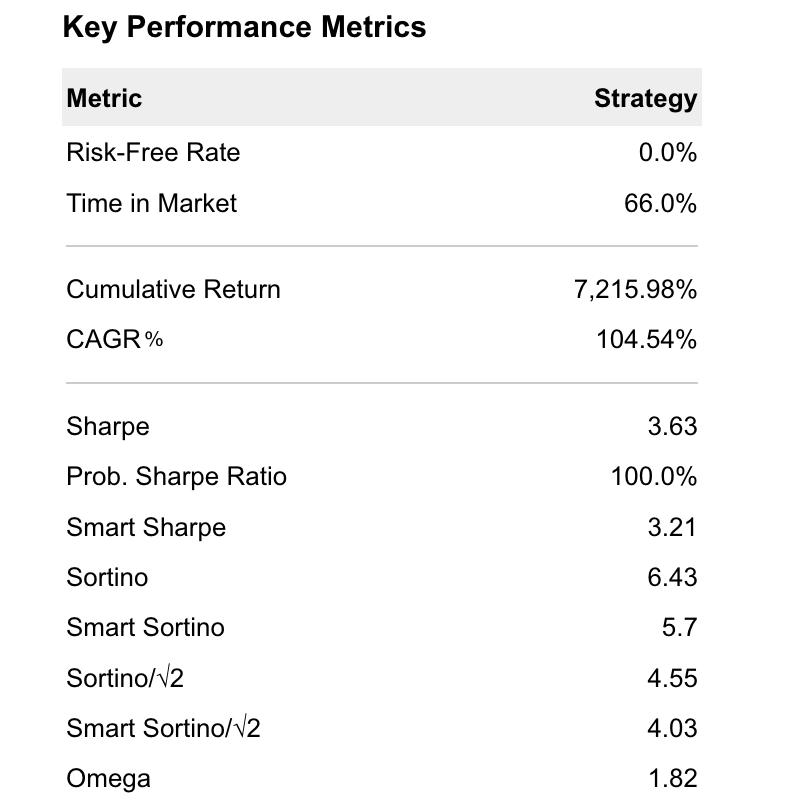

During Bitcoin’s parabolic rise in 2017, on-chain activity surged well before the final price blow-off. Active addresses and transaction volume climbed consistently through the year, signaling increasing adoption. MVRV also rose into overvalued territory above 3.5, warning that the market was overheating. Algorithms that incorporated these signals reduced exposure near the top, avoiding catastrophic drawdowns during the 2018 crash.

Bitcoin 2020–2021 Rally

The bull run from late 2020 into 2021 was characterized by institutional inflows and strong accumulation. Exchange outflows reached record highs, showing that Bitcoin was moving into cold storage rather than being sold. SOPR consistently stayed above 1, signaling that holders were realizing profits but reinvesting. Algorithms monitoring these metrics increased long exposure, capturing one of the strongest rallies in Bitcoin’s history. When exchange inflows spiked in May 2021, signaling increased sell pressure, these same systems reduced exposure ahead of the 50% drawdown.

Ethereum and the Merge (2022)

Leading up to Ethereum’s Merge upgrade in September 2022, on-chain data painted a mixed picture. Transaction volumes surged as traders positioned themselves, but exchange inflows also increased, suggesting caution. Algorithms that monitored this dual signal positioned defensively, reducing leverage. After the Merge, when on-chain outflows resumed, these systems scaled back into longs, aligning with the post-event recovery.

Limitations of On-Chain Metrics

While powerful, on-chain data has its limits.

- Lagging Effect: Some metrics, such as MVRV or SOPR, are more reflective than predictive, and may confirm trends rather than forecast them.

- Noise in Retail-Dominated Assets: Retail-driven altcoins often show erratic on-chain activity, producing false signals.

- Centralized Exchange Activity: Significant portions of crypto trading still happen off-chain, meaning large capital movements may not always appear immediately on-chain.

- Interpretation Bias: Metrics like whale activity can be ambiguous — large inflows could signal either selling pressure or exchange custodial reshuffling.

Algorithms must treat on-chain data as one part of a broader system, integrating it with technical analysis, sentiment, and macro data for stronger robustness.

Practical Recommendations for Algorithmic Traders

- Combine Metrics: Use multiple on-chain indicators together rather than relying on a single metric. For example, combine exchange flows with SOPR for clearer signals.

- Integrate with TA: Align on-chain data with price action to confirm or invalidate signals.

- Automate Monitoring: Implement real-time pipelines to process blockchain data feeds (e.g., Glassnode API, CryptoQuant) directly into trading systems.

- Build Filters: Avoid overtrading on noisy signals by setting thresholds and requiring confirmation from multiple metrics.

- Test Across Regimes: Backtest on-chain strategies across bull, bear, and sideways markets to ensure robustness.

On-chain metrics are a unique advantage of cryptocurrency markets, offering transparency unavailable in traditional finance. They allow traders to monitor investor behavior, liquidity flows, and capital shifts directly from the blockchain. For algorithmic trading, these metrics are not just supplementary — they are transformative.

By integrating signals such as exchange inflows/outflows, MVRV ratios, SOPR, HODL Waves, and whale activity, algorithms gain an edge in anticipating volatility, adjusting risk, and identifying market tops and bottoms.

Yet, on-chain data is not a magic bullet. It must be combined with technical and fundamental analysis, and its signals must be filtered carefully to avoid noise. When applied correctly, however, on-chain metrics provide algorithms with a deeper layer of insight, turning raw blockchain transparency into actionable trading intelligence.

In an industry defined by uncertainty and rapid change, the ability to see beneath the surface — into the blockchain itself — offers traders a decisive edge. The future of algorithmic trading in crypto will not be built solely on charts and indicators, but on the powerful combination of on-chain data and advanced models that can turn transparency into opportunity.