Algorithmic trading has evolved significantly over the last two decades. Early systems often relied on a single model or strategy, optimized for a specific market condition. While such systems could deliver impressive returns during favorable regimes, they tended to break down once the environment changed. Markets are not static; they oscillate between trends, ranges, high volatility, and low volatility. A single algorithm, no matter how sophisticated, cannot perform consistently across all these states.

This is where the concept of multi-strategy portfolios, often referred to as “baskets of algorithms,” becomes crucial. Instead of relying on one trading system, professional traders and hedge funds deploy a diverse set of algorithms—each with its own design, edge, and regime preference. By combining these strategies under a unified risk management framework, they achieve smoother equity curves, reduced drawdowns, and more robust long-term performance.

The purpose of this article is to explore how multi-strategy algorithmic portfolios reduce risk and improve consistency, why a single algorithm cannot handle all market conditions, and how diversification across models provides the resilience needed to succeed in today’s complex financial landscape.

The Concept of the “Basket of Algorithms”

Defining Multi-Strategy Portfolios

A multi-strategy algorithmic portfolio is a collection of independent trading systems, each designed with a different logic, asset focus, or time horizon. Unlike discretionary traders who rely on intuition, algorithms follow strict rules. But just as investors diversify across asset classes, algorithmic traders diversify across strategies.

For example, a basket might include:

- A momentum trend-following algorithm that rides extended moves.

- A mean reversion algorithm that exploits overreactions.

- A volatility breakout algorithm that activates when markets become unstable.

- A statistical arbitrage model that trades spreads between correlated assets.

- A news-sentiment-driven algorithm that reacts to external data inputs.

The combined effect is a portfolio that is less dependent on any single outcome.

Institutional Inspiration

Large hedge funds like Renaissance Technologies, AQR Capital, and Two Sigma have long embraced multi-strategy frameworks. While their models are proprietary, their structure reflects the principle of diversification at the algorithmic level. Renaissance’s Medallion Fund, often considered the most successful hedge fund in history, is widely believed to operate hundreds of small, uncorrelated strategies simultaneously.

Analogy to Traditional Investing

The concept mirrors traditional portfolio theory introduced by Harry Markowitz in the 1950s. Just as a mix of stocks, bonds, and commodities reduces portfolio risk, a mix of trading algorithms—each with different return distributions—creates a smoother performance curve.

Why One Algorithm Cannot Work in All Conditions

Market Regimes Are Dynamic

Markets are complex adaptive systems. They go through different regimes:

- Trending phases (bull or bear markets).

- Range-bound periods (low volatility, sideways action).

- High volatility clusters (crashes, panics, euphoria).

- Liquidity-driven anomalies (central bank interventions, sudden news).

An algorithm optimized for one regime often underperforms in another. For instance, a trend-following system thrives in strong bull markets but suffers during sideways conditions with frequent whipsaws. Conversely, mean reversion systems profit in ranges but are destroyed during sustained trends.

The Risk of Overfitting

Another problem with relying on a single algorithm is overfitting. A model might perform brilliantly in backtests because it was tailored to historical quirks, but it collapses in live trading when conditions differ. By running multiple strategies, traders reduce reliance on any single “fragile” edge.

Real-World Example

Consider the 2008 financial crisis. Momentum algorithms captured the cascading declines in equities, while mean reversion strategies were repeatedly whipsawed. After central banks intervened in 2009, trends reversed sharply, and mean reversion strategies regained dominance. A trader with only one of these systems would have experienced either ruinous losses or missed opportunities. A portfolio of both would have smoothed returns.

Benefits of Diversification Across Algorithms

Reduction of Volatility

When strategies are uncorrelated, losses in one can be offset by gains in another. For example, a volatility breakout system may generate profits during market crashes, balancing losses from long-only trend systems.

Lower Maximum Drawdowns

Drawdown is a critical metric for traders. Institutional investors demand smooth equity curves because large drawdowns erode confidence and capital. Multi-strategy portfolios distribute risk, ensuring no single algorithm can cause catastrophic damage.

Smoother Equity Curves

Consistency is more valuable than occasional spikes in performance. A diversified basket produces gradual, steady growth rather than boom-and-bust cycles. This is attractive to both traders and investors seeking stable returns.

Capital Efficiency

By spreading exposure across different strategies, traders use capital more efficiently. Instead of idle funds waiting for the right market condition, capital is constantly at work through different systems adapted to different scenarios.

Mathematical Foundation of Diversification

The risk-reduction benefits of multi-strategy portfolios can be quantified using the variance formula for a portfolio of strategies:

Case Study: Crypto Trading Portfolio

Crypto markets are a perfect example of why multi-strategy portfolios are essential. They are volatile, fragmented, and driven by both technical and behavioral factors.

A well-designed crypto portfolio might include:

- Trend-following algorithms for bull runs.

- Mean reversion systems for sideways periods.

- Volatility cluster detectors to prepare for breakouts.

- On-chain data models tracking capital flows between wallets.

By combining these, traders achieved lower drawdowns during the 2018 bear market and captured significant profits during the 2020–2021 bull market.

Institutional Approaches to Multi-Strategy Portfolios

Hedge funds and proprietary trading firms have long understood that relying on a single model is too risky. Instead, they build complex multi-strategy frameworks, deploying dozens or even hundreds of algorithms at the same time. Each algorithm is designed to operate independently, with its own rules, entry and exit conditions, and asset focus.

Renaissance Technologies: The Medallion Example

The Medallion Fund, managed by Renaissance Technologies, is often cited as the most successful hedge fund in history. While the fund’s details are secret, industry insiders believe it runs hundreds of micro-strategies simultaneously. Some are designed for equities, others for futures, currencies, or options. The key is not the brilliance of any single strategy, but the collective power of a diversified system where losses in one area are offset by gains in another.

AQR Capital and Factor Diversification

AQR Capital Management, co-founded by Clifford Asness, emphasizes factor-based investing. Momentum, value, carry, and defensive factors are combined across asset classes and time horizons. The firm applies this principle not only in discretionary portfolios but also in quantitative, algorithm-driven systems. Their philosophy is clear: no single factor or strategy works in all conditions, but together they deliver robustness.

Proprietary Trading Desks

Proprietary trading firms (prop shops) operating in equities, futures, and crypto markets also rely on baskets of algorithms. A typical prop desk may deploy:

- Short-term mean reversion scalpers

- Medium-term trend-following systems

- Options volatility models

- News-driven sentiment algorithms Each of these is risk-managed separately but aggregated under one portfolio manager who monitors capital allocation.

Capital Allocation Across Algorithms

One of the biggest challenges in running multi-strategy portfolios is deciding how much capital to allocate to each strategy. Professionals use a mix of quantitative and qualitative methods to achieve this.

Risk Parity Approach

In risk parity, strategies are allocated capital based on their volatility rather than expected returns. For example, a high-volatility momentum strategy may receive a smaller allocation, while a low-volatility arbitrage system receives more. The goal is to equalize risk contribution across strategies.

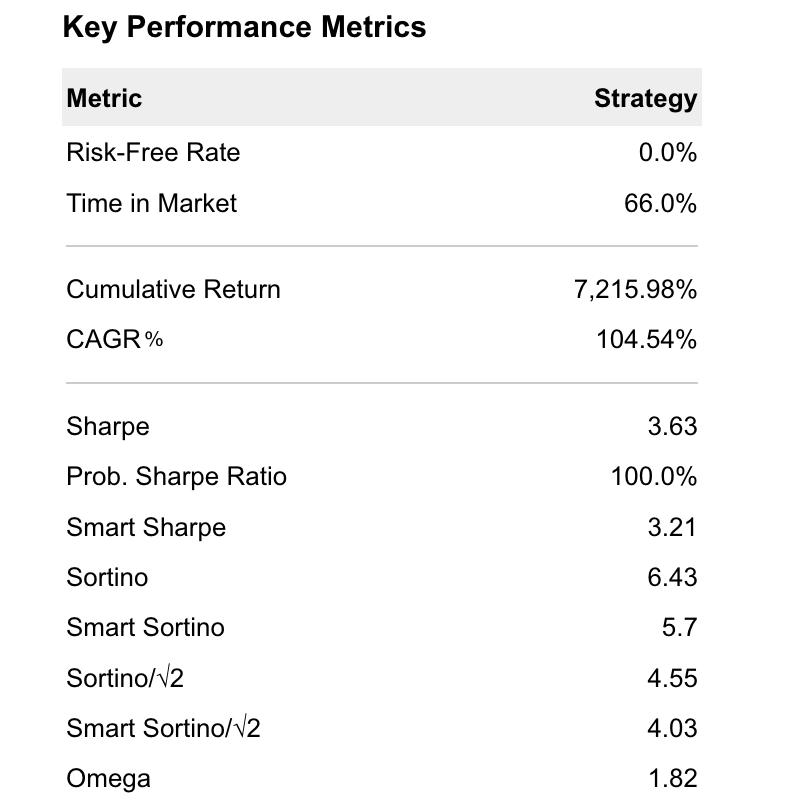

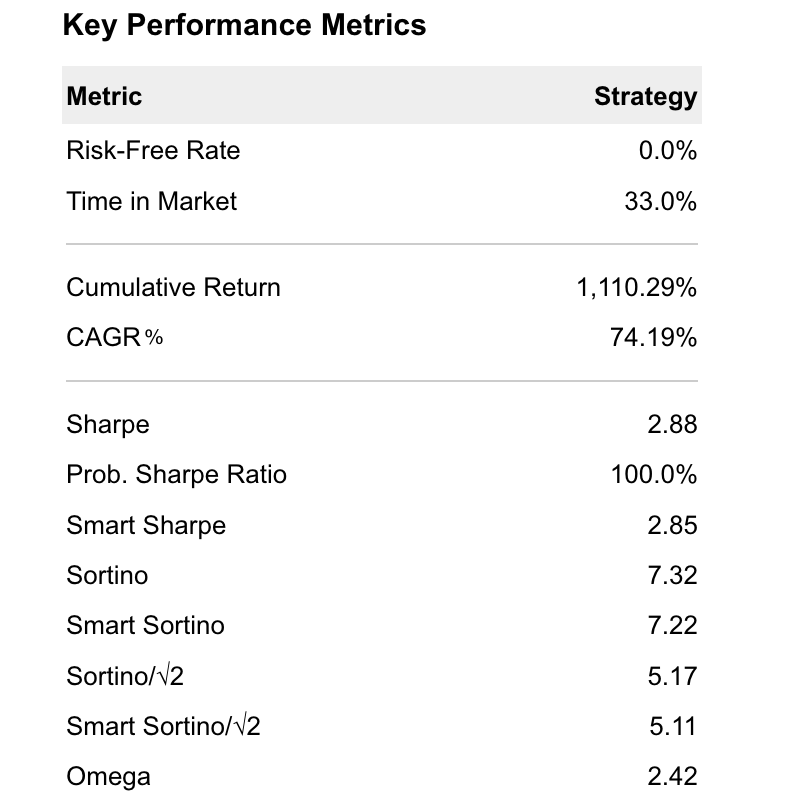

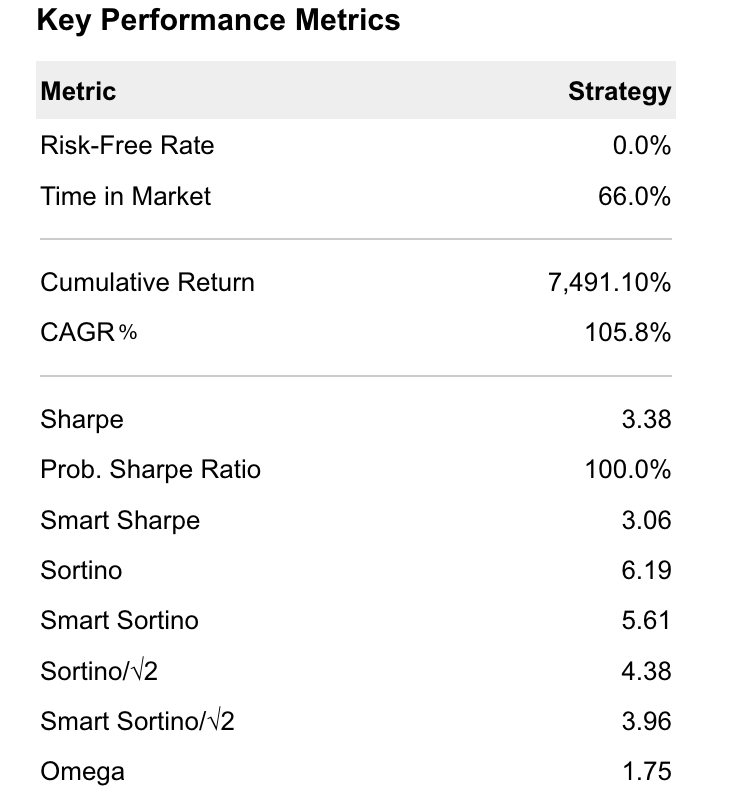

Sharpe and Sortino Ratios

Traders also evaluate the risk-adjusted performance of strategies using metrics such as the Sharpe ratio (return per unit of volatility) and the Sortino ratio (return per unit of downside risk). Capital is allocated more heavily toward systems with consistently strong risk-adjusted returns.

Dynamic Rebalancing

Capital allocation is not static. Professional desks rebalance portfolios regularly based on current performance, correlations, and market regimes. For example, during volatile markets, they might reduce exposure to mean reversion systems prone to whipsaws and increase exposure to breakout algorithms.

Case Study: Reducing Drawdowns with Diversification

Consider a portfolio with two independent strategies:

- Strategy A: Trend-following system with 20% annual return and 25% maximum drawdown.

- Strategy B: Mean reversion system with 15% annual return and 20% maximum drawdown.

If run separately, each strategy experiences significant drawdowns. However, when combined in equal weights, the portfolio produces an 18% annual return with only a 15% maximum drawdown, because their losses do not occur at the same time. This is the power of diversification.

In live trading, multi-strategy portfolios have proven to reduce drawdowns during crises. For example, during the COVID-19 crash of 2020, trend-following algorithms captured the equity collapse, while volatility breakout systems made profits on sharp intraday moves. Mean reversion strategies suffered initially, but recovered quickly during the rebound. The net effect was a smoother portfolio curve compared to running any single system.

Psychological Benefits of Multi-Strategy Portfolios

Diversification also helps traders psychologically. Watching a single algorithm go through a long losing streak can cause frustration and poor decision-making. Many traders shut down systems too early, only to see them recover later. By running multiple strategies at once, the probability of all of them failing simultaneously decreases dramatically. This creates confidence, discipline, and patience to stick with the portfolio through inevitable market fluctuations.

Advanced Methods for Building Multi-Strategy Portfolios

Correlation Analysis

The cornerstone of diversification is correlation. Two strategies may look different on paper, but if their returns are highly correlated, combining them provides little benefit. For example, two momentum systems on similar timeframes and assets will likely move together. True diversification comes from mixing strategies with low or negative correlations.

Volatility Clustering and Regime Switching

Markets exhibit volatility clustering: calm periods are followed by turbulence. Algorithms that detect volatility regimes can dynamically shift capital between strategies. For example:

- In low volatility regimes, mean reversion systems thrive.

- In high volatility regimes, breakout and momentum systems dominate.

Volatility can be modeled using GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models or more modern machine learning techniques. These models help identify regime shifts and guide allocation between algorithms.

Machine Learning for Strategy Selection

Machine learning enhances multi-strategy portfolios by identifying when specific strategies are likely to succeed or fail. For example:

- Classification models (logistic regression, random forests, gradient boosting) can predict whether the next regime will favor momentum or mean reversion.

- Reinforcement learning agents can dynamically allocate capital between algorithms based on reward optimization.

- Neural networks can capture non-linear relationships between strategies and market states.

Ensemble Learning Analogy

In machine learning, ensemble methods (like Random Forests) combine multiple weak learners to create a stronger predictor. Multi-strategy trading portfolios follow the same principle: combining many independent algorithms, even if individually weak, often produces a powerful, stable system.

Additional Mathematical Tools

Portfolio Expected Return

The expected return of a multi-strategy portfolio is the weighted sum of the individual returns:

Maximum Drawdown Control

Drawdowns can be reduced by setting portfolio-level risk limits. For example, halting all strategies if the total equity curve falls by more than 10% within a given period. This prevents catastrophic damage when multiple systems misfire simultaneously.

Real-World Cases of Multi-Strategy Success

Case 1: Equity Hedge Funds in the 2008 Crisis

During the 2008 financial crisis, single-strategy funds suffered massive losses. However, multi-strategy hedge funds that combined trend-following, volatility arbitrage, and credit strategies fared better. Losses in equities were offset by gains in volatility and credit spreads.

Case 2: Crypto Multi-Strategy Desks (2017–2022)

Crypto markets are highly volatile, making them fertile ground for algorithmic diversification. One crypto desk reported the following structure:

- 40% allocated to trend-following algorithms.

- 30% to mean reversion systems.

- 20% to volatility breakout models.

- 10% to arbitrage (cross-exchange spreads, funding rate discrepancies).

The result was a smoother equity curve than any single system could achieve. Even during the 2018 bear market, losses were contained because volatility arbitrage strategies profited from market turbulence.

Case 3: High-Frequency Trading Firms

HFT firms routinely run dozens of micro-strategies simultaneously. Some scalp bid-ask spreads, others exploit order flow, and some run short-term arbitrage between correlated instruments. Each strategy has a small edge, but together they compound into consistent profitability.

Challenges of Multi-Strategy Portfolios

While diversification provides benefits, managing multi-strategy portfolios introduces new challenges:

- Complexity: More algorithms mean more moving parts. Monitoring performance and ensuring execution stability becomes harder.

- Over-Diversification: Running too many strategies dilutes returns and increases transaction costs. The goal is balance, not quantity.

- Correlation Drift: Correlations are not stable. Strategies that appeared uncorrelated in backtests may become correlated in live markets.

- Execution Risk: Running multiple systems can lead to conflicts, such as two strategies placing opposite orders on the same asset. Proper execution management systems are necessary.

Step-by-Step Guide to Building a Multi-Strategy Portfolio

Step 1: Define Objectives and Constraints

Before building a portfolio, traders must define their risk tolerance, return objectives, and constraints such as maximum drawdown limits, liquidity requirements, and leverage thresholds. These guide the selection and allocation of algorithms.

Step 2: Select Independent Strategies

Choose algorithms with distinct logic and timeframes. For example:

- Momentum system on equities with a daily timeframe.

- Mean reversion system on forex pairs with intraday signals.

- Volatility breakout model for crypto futures.

- Statistical arbitrage system on correlated ETFs.

The key is independence. If two algorithms generate highly correlated return streams, they don’t add diversification value.

Step 3: Backtest and Stress Test Each Strategy

Each system should undergo robust backtesting and stress testing. Include different market regimes (bull, bear, sideways, crisis) to evaluate robustness. Monte Carlo simulations can provide insights into tail risks.

Step 4: Calculate Correlations and Optimize Allocation

Use correlation matrices to understand relationships between strategies. Allocate capital based on volatility, Sharpe ratio, and diversification benefit. Techniques such as mean-variance optimization or risk parity can be applied, though many professionals favor more pragmatic, heuristic approaches.

Step 5: Implement Portfolio-Level Risk Controls

Risk management must extend beyond individual strategies. Implement:

- Daily loss limits.

- Maximum drawdown thresholds.

- Portfolio-level stop-losses.

- Automated kill switches.

These ensure that even if multiple strategies fail simultaneously, capital is protected.

Step 6: Deploy Gradually and Monitor in Real-Time

Start with small allocations and scale up once strategies prove stable in live conditions. Use real-time dashboards to track PnL, exposure, and performance of each algorithm.

Step 7: Adapt and Evolve

Markets evolve, and so must portfolios. Review performance regularly, retire underperforming systems, and introduce new ones. The composition of a multi-strategy portfolio should never remain static.

Checklist for Traders

- Am I relying on a single algorithm?

- Do my strategies represent different logics (momentum, mean reversion, arbitrage, volatility)?

- Have I tested each algorithm across multiple market regimes?

- Do I know the correlations between my systems?

- Do I have portfolio-level drawdown controls in place?

- Am I monitoring performance in real time?

- Do I regularly adapt and rebalance my strategy mix?

Conclusion

The belief that one perfect algorithm exists to conquer all markets is a myth. Financial markets are dynamic, constantly shifting between regimes of trend, range, volatility, and liquidity. Algorithms are powerful, but each one has a limited scope. Relying on a single model leaves traders vulnerable to sudden shifts and prolonged underperformance.

Multi-strategy portfolios provide the resilience needed to thrive. By combining diverse, independent algorithms into a structured basket, traders reduce drawdowns, smooth equity curves, and improve the consistency of returns. This approach mirrors the diversification principles of traditional investing, but at a more granular, systematic level.

Professional firms have long embraced this philosophy. Hedge funds like Renaissance Technologies and AQR Capital build vast libraries of models, not because each is perfect, but because together they create a robust, adaptable machine. The same principle applies to smaller trading operations: build a toolbox of algorithms, manage them under a disciplined risk framework, and evolve as markets evolve.

In the end, the power of multi-strategy portfolios is not just in profit generation, but in survival. Markets will always change. Single strategies will always fail eventually. But portfolios built on the principle of diversification — baskets of algorithms designed to complement one another — provide the path to sustainable, consistent success in algorithmic trading.