Legal Information

This page contains a list of documents regulating the activity of Aquila Private

AML & KYC Policy

Effective Date: November 3, 2025

This Know Your Customer (KYC) and Anti‑Money Laundering (AML) Policy is implemented by Aquila Private LTD, a company registered in the United Kingdom of Great Britain and Northern Ireland (“Company”), in accordance with applicable UK legislation and international FATF standards. This Policy applies to the use of the Website https://aquila-private.com and the connected Platform interface at https://aquila-private.app (“Platform”). By using the Platform, you confirm your agreement with this Policy and consent to the verification procedures described herein.

Purpose of the Policy

The Company conducts KYC/AML procedures to: verify user identity; comply with UK regulations and sanctions regimes; prevent fraud, financial crime, and illegal transactions; protect the Platform and its users; reduce legal, compliance, and reputational risks. The Platform provides access to algorithmic trading strategies supplied by a third‑party provider, IQ SECURITY FUND INC. (Panama). Personal data collected under this Policy is not shared with the strategy provider.

Verification Requirements

Identity verification may be requested in the following cases: withdrawal of bonuses or affiliate rewards; activation of the affiliate/referral program; exceeding usage thresholds (e.g. more than 1,000 USDT equivalent activity); detection of suspicious or abnormal account activity; compliance with sanctions checks. KYC is not required to browse the Website or use non‑custodial API connections unless triggered by the above conditions.

Depending on risk level, the Platform may request: identity document (passport, ID card, driver’s license); selfie with document; proof of residential address (no older than 90 days); additional documentation confirming source of funds or wealth (SoF/SoW).

Verification levels: Level 1 — basic registration (email, name, country). Level 2 — verified account (ID, selfie, address proof). Level 3 — enhanced due diligence for high‑risk or high‑volume accounts (SoF/SoW and supporting evidence). The Company may apply individual risk‑based measures and request additional information at its discretion.

Sanctions and Monitoring

The Company conducts automatic and manual monitoring including: IP and geolocation checks; screening against global sanctions lists (OFAC, OFSI, UN, EU, FATF high‑risk jurisdictions); detection of VPN abuse, false identities, front persons, or multi‑accounts; investigation of suspicious activity; temporary or permanent blocking of access if risk is identified; freezing of affiliate or bonus‑related payouts during review. The Company may deny service without prior notice if a compliance or sanctions risk is detected.

Data Protection and Storage

All data collected during KYC/AML procedures is processed in accordance with UK GDPR requirements. The Company implements encryption, secure storage, access controls, and internal security protocols. Data is retained only as long as required by law or risk‑control obligations and then securely deleted or anonymized. Data is not shared with unauthorized third parties except when required by law, regulatory authorities, or court orders.

Restricted Jurisdictions

The Platform does not provide services to users located in or acting on behalf of persons in restricted or sanctioned jurisdictions. These include but are not limited to: United States, Canada, Israel, Iran, North Korea, Syria, Cuba, Afghanistan, Sudan, South Sudan, Yemen, Zimbabwe, Central African Republic, and all territories of Ukraine. Attempts to bypass restrictions using VPNs, false information, or intermediary accounts constitute a violation of this Policy and may result in account termination.

Affiliate Program Requirements

Full KYC verification is required to withdraw affiliate or referral rewards. The Company may refuse or cancel payouts in case of fraud, multiple accounts, identity manipulation, or KYC evasion attempts. Payments may be temporarily frozen pending compliance review.

Cooperation with Authorities

The Company complies with applicable UK regulatory obligations and cooperates with law‑enforcement and competent authorities in matters relating to money laundering, sanctions evasion, terrorism financing, or fraud.

User Responsibilities

Users must: provide accurate and truthful information; complete KYC upon request; not use forged or third‑party documents; comply with applicable laws and Platform policies. Violation may result in suspension, termination, cancellation of bonuses, or access restrictions.

Policy Updates

The Company may update this Policy at any time. The latest version is published on the Website and takes effect upon posting. Continued use of the Platform constitutes acceptance of any changes.

solutions

Strategic Models for Independent Users

Aquila Private’s algorithmic models are built for data transparency and user-managed execution — combining smart analytics, risk filters, and real-time integration.

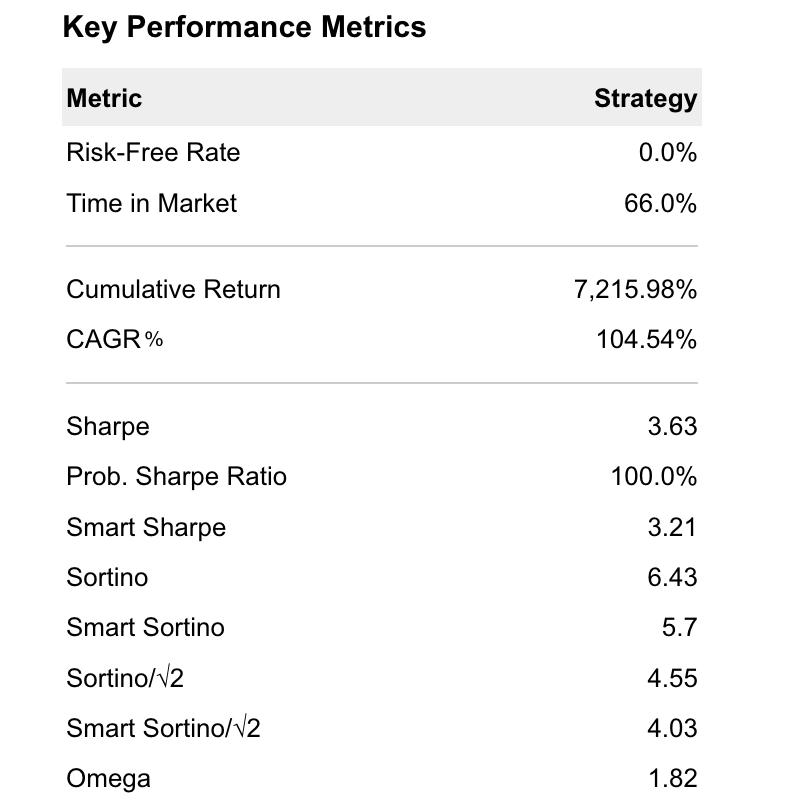

Private Basket-70

- Total Return (5Y): 7215%

- Risk Level: Elevated

- Average Monthly Return: 7.51%

- Max drawdown per day: -14.58%

- Maximum drawdown: -19.98%

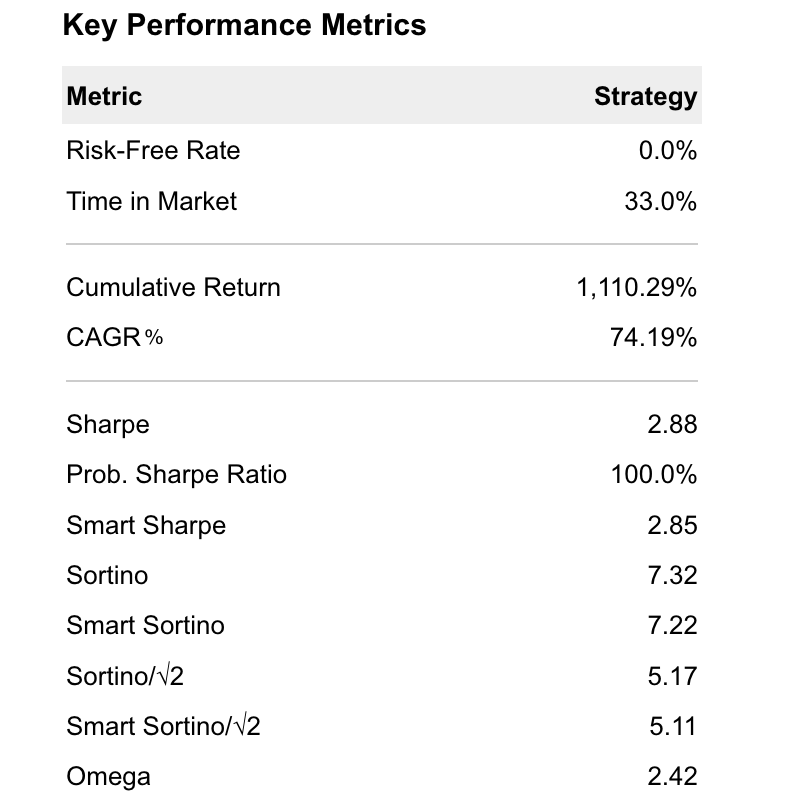

Private-Dynamic

- Total Return (4Y): 1110%

- Risk Level: Low

- Average Monthly Return: 4.93%

- Max drawdown per day: -10.28%

- Maximum drawdown: -13.15%

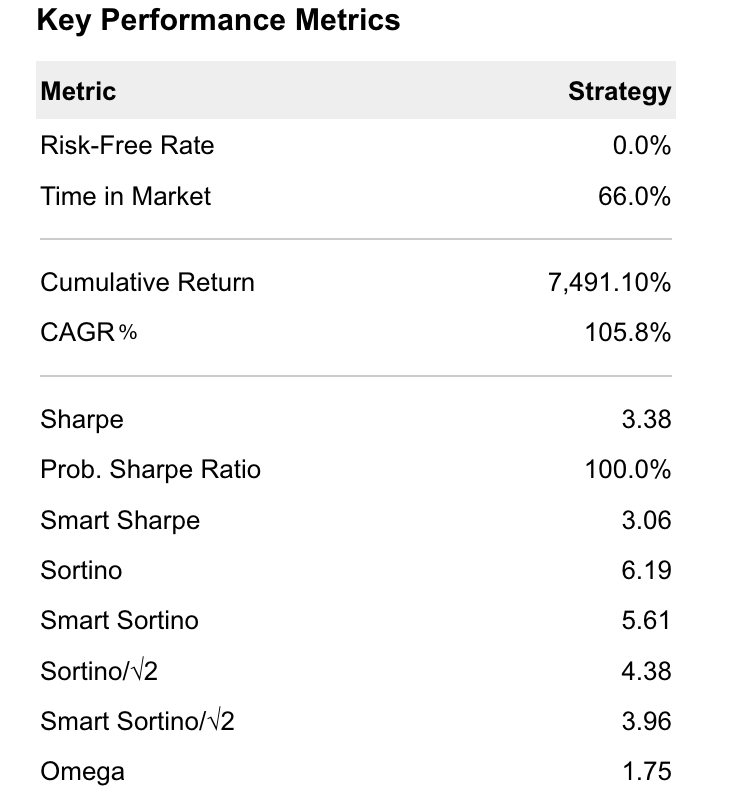

Private Basket-50

- Total Return (5Y): 7491%

- Risk Level: Moderate

- Average Monthly Return: 5.15%

- Max drawdown per day: -14.58%

- Maximum drawdown: -19.99%

Early testing shows promising historical consistency. These strategies will become available through your Aquila Private account soon.

* All performance data reflects historical model behavior. No guarantees. Not investment advice.

Where Private Users Explore Institutional Tools

Access algorithmic models through the same technical interface used by professional participants — fully non-custodial and under your control.

news

Financial Reviews & Market Insights

Stay ahead with expert analysis and curated updates from the crypto and macro world.

faq

Support & Guidance You Can Trust

Your funds remain in your personal exchange account. Connection is established via read-only API or supported third-party platforms. We never have access to your assets, and no withdrawals are possible through our systems.

Yes. Our team provides full onboarding support. You don’t need prior trading knowledge — the connection is simple and guided.

We offer a subscription model starting at 100 USDT. It includes access to strategy connectors, analytics, and updates. Payment is made in cryptocurrency.

Our system supports major exchanges like Binance, OKX, Bybit, Bitget, and KuCoin. Strategies are mirrored to your account automatically — no asset custody is involved.

Your funds and any trading results remain in your exchange account. You can withdraw at any time directly from the exchange — we do not hold or restrict access.

Based on historical simulations, individual strategies have shown annualized performance ranging from 75% to over 247%, depending on market conditions and selected risk levels. These results reflect past model behavior only and do not guarantee future returns. Use this data for informational and analytical purposes only.

We offer access through a revenue-sharing model. Our infrastructure enables wider usage while aligning incentives — we only earn when performance is delivered.

Contacts

Get in Touch

We’re here to support you at every step. Whether you have questions about the platform or need help getting started, our team is available to assist you.

IT Development address (UK):

- Aquila Private LTD

- 14174, 182–184 High Street North East Ham, London, E6 2JA, UK

Marketing Office (USA):

- Aquila Private LLC

- 2125 Biscayne Blvd, Ste 204 #21573 Miami, FL 33137, USA

- (non-client office — no financial services provided)

General inquiries:

Trust Results, Not Promises

With Aquila Private, your capital remains fully under your control while our interface helps connect you to algorithmic models. We provide access — decisions and outcomes are always in your hands.