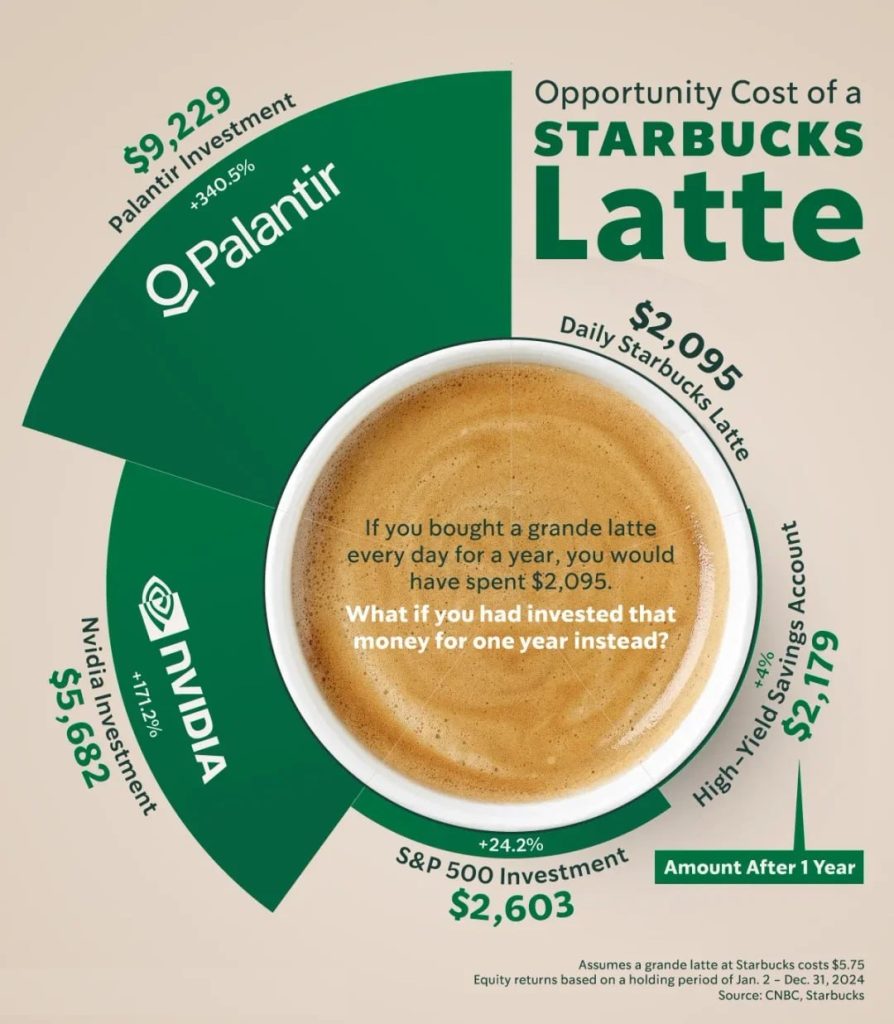

What your daily latte could become in the right hands

I recently came across an article on Visual Capitalist where the authors posed a question that stuck with me:

What if, instead of spending $5.74 on a Starbucks latte every day, you had invested that money over the course of a year?

Every morning, millions of people buy coffee. It’s a ritual. A reset. A reward. We rarely question it—after all, how much impact can a few dollars a day really have?

But the truth is: a small habit, multiplied by time and consistency, becomes capital. Real capital.

At $5.74 per day, you’re spending $2,095 per year. Now let’s look at what could have happened to that same amount in 2024.

The Latte Opportunity Cost

According to Visual Capitalist’s data, here’s how a $2,095 investment would have performed in 2024 depending on where you placed it:

It’s a compelling comparison. But we decided to go one step further.

What if that money was put into Aquila Reverse?

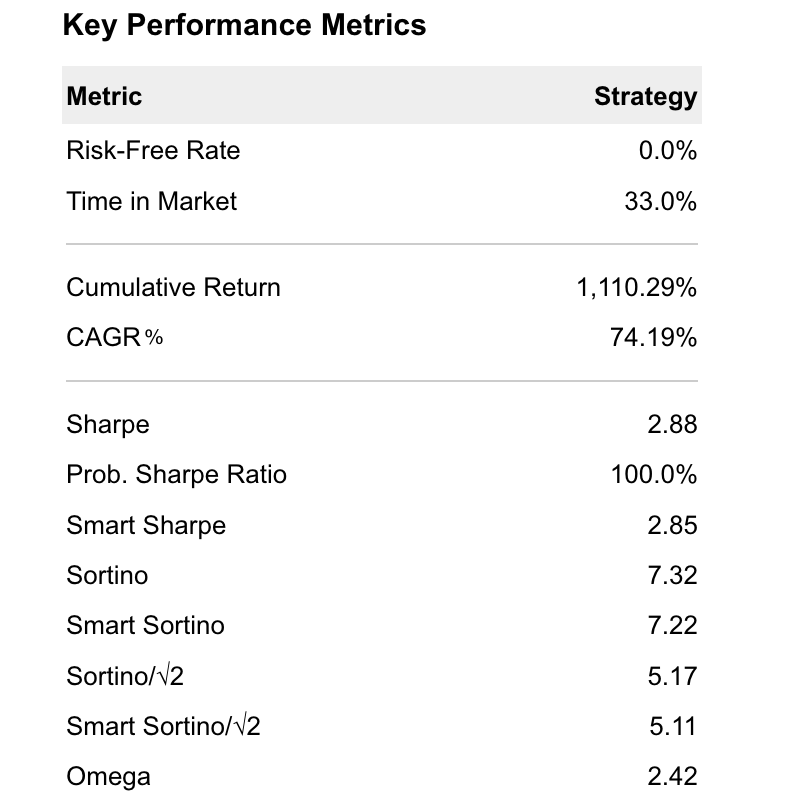

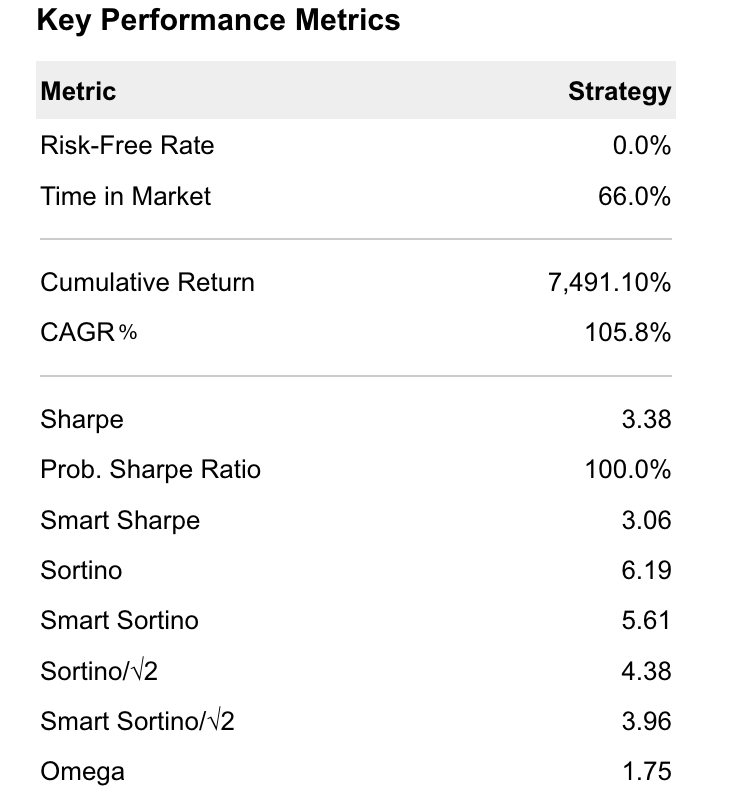

To find out, we ran the same scenario through our algorithmic trading system: Aquila Reverse.

This is a multi-algorithm strategy that operates on BTC and ETH perpetuals with capital preservation, fixed-risk logic, and clear risk-reward optimization. It doesn’t rely on news or sentiment, but on rules, volatility signals, and price behavior.

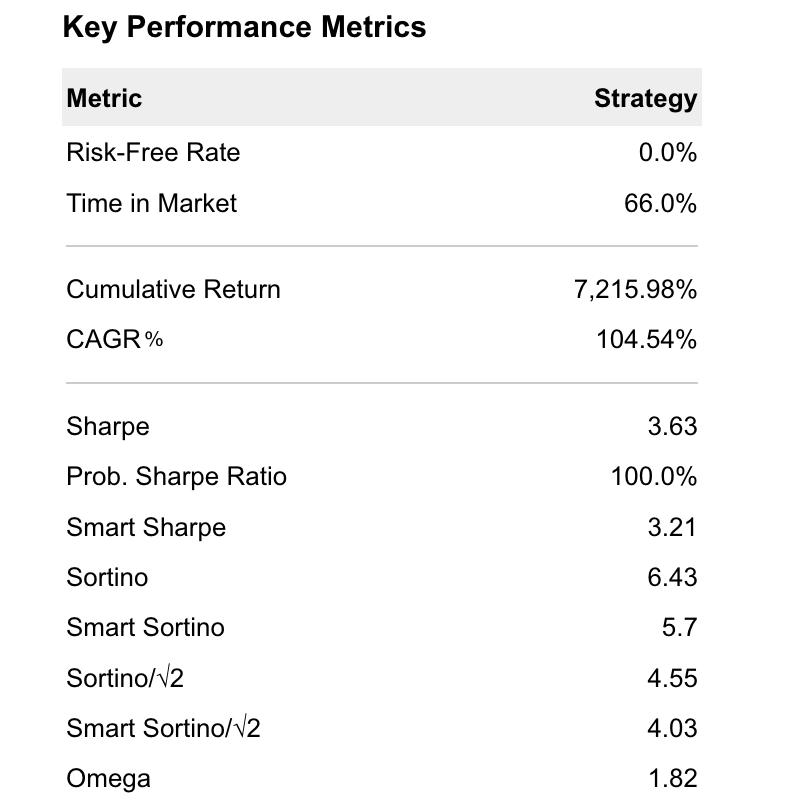

Here’s the actual monthly performance of Aquila Reverse in 2024:

When compounded monthly, that adds up to:

+412.09% annual return $2,095 → $10,728.21

This isn’t theoretical. These are live, real-time trading results, tracked and verified through QuantStats reporting, with all trades executed via major crypto exchanges using Smart Order Routing and TWAP modules.

A Fair Comparison

One is a moment of joy. The other is a model of compound growth.

Final Thought

This isn’t about guilt-tripping anyone out of a morning ritual. It’s about showing the silent cost of small habits—and the massive upside of making them intentional.

The real takeaway isn’t “skip your coffee.” It’s this:

What else are you unconsciously spending $5 a day on… that could be building long-term capital instead?

If you’re curious about Aquila Reverse and want to explore the data deeper, I’d be glad to share the performance deck and explain how it works.

Let your habits serve your future.