What Are Private Strategies — And Why Are They Hidden?

On the crypto market, “private strategies” are increasingly mentioned as high-performing systems promising extraordinary returns. But what makes them different from public strategies — and why aren’t they available to everyone?

Private strategies are proprietary trading models built by experienced quants, developers, and traders. Unlike public bots or strategies on open copy-trading platforms, these models are not publicly listed, downloadable, or shared. Access is granted only after investor verification, a subscription, and delivery of a private link or API key setup.

Why the secrecy? Because scale kills alpha. Many high-performing strategies work well only under limited capital exposure. Mass access or sharing the mechanics compromises profitability, creates slippage, and exposes intellectual property to reverse engineering.

Is 300% a Year Real? Let’s Break It Down

Returns of 300% sound unrealistic. But in crypto — with extreme volatility and smart positioning — it’s possible under the right conditions.

Here’s the truth:

- High returns are concentrated in volatile, trending phases

- Monthly returns fluctuate — profits are not evenly distributed

- Most strategies apply momentum and mean-reversion models

- Compounding (reinvesting profits) dramatically amplifies long-term growth

At Aquila Private, these results are backed by QuantStats analytics. For instance, our Aquila 70 strategy has historically delivered over 5,000% cumulative returns over multiple years.

Subscription-Based Access: How It Works

A subscription provides paid access to a private trading strategy. With Aquila Private, your subscription includes:

- Secure access via CopyTrading or API

- Step-by-step technical guidance

- Live reporting and performance transparency

- Real-time control: pause or disconnect anytime

- Full capital protection (no fund transfers)

Two Access Models

| Plan | Capital | Method |

|---|---|---|

| Retail | From $5,000 | CopyTrading |

| Institutional | From $100,000 | API Integration |

In both models, your funds remain in your exchange account. We never custody assets.

Step-by-Step: Connecting to a Private Strategy

- Create an account on Aquila Private

- Select a strategy based on your capital and risk tolerance

- Pay your subscription (in USDT)

- Receive your private link or API instructions

- Connect your account (Binance, OKX, Bybit, etc.)

- Start trading — all activity happens on your account in real time

We provide the logic. You keep control.

What You Get with a Private Strategy Subscription

- Fully automated 24/7 trading

- Strict risk management per position

- Built-in stop-loss and take-profit logic

- Live PnL tracking, volatility and drawdown reports

- Transparency: every trade visible in your own exchange

You can pause, disconnect, or switch strategies anytime — no third-party approval needed.

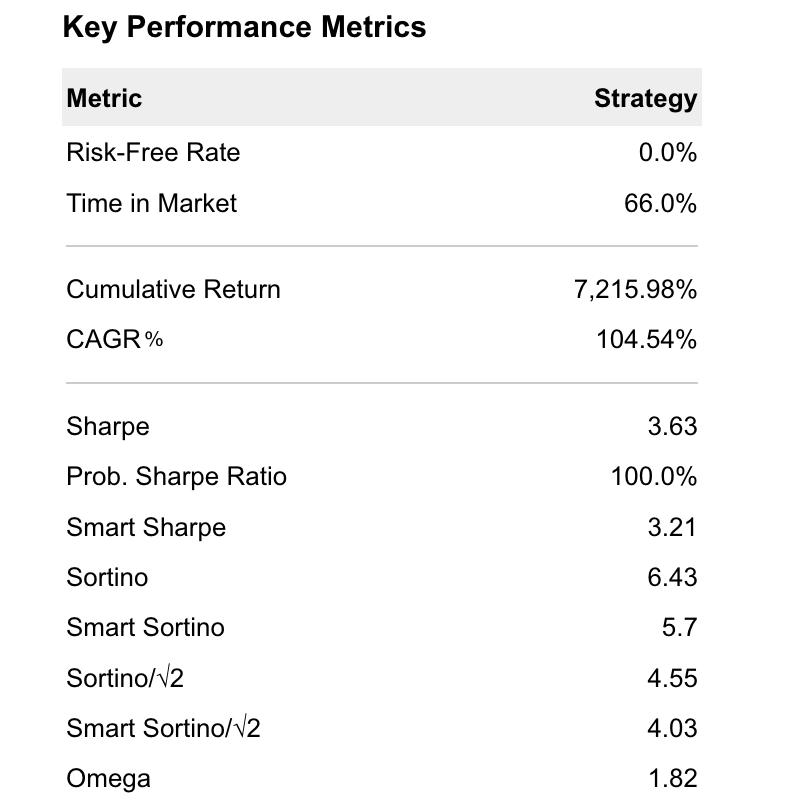

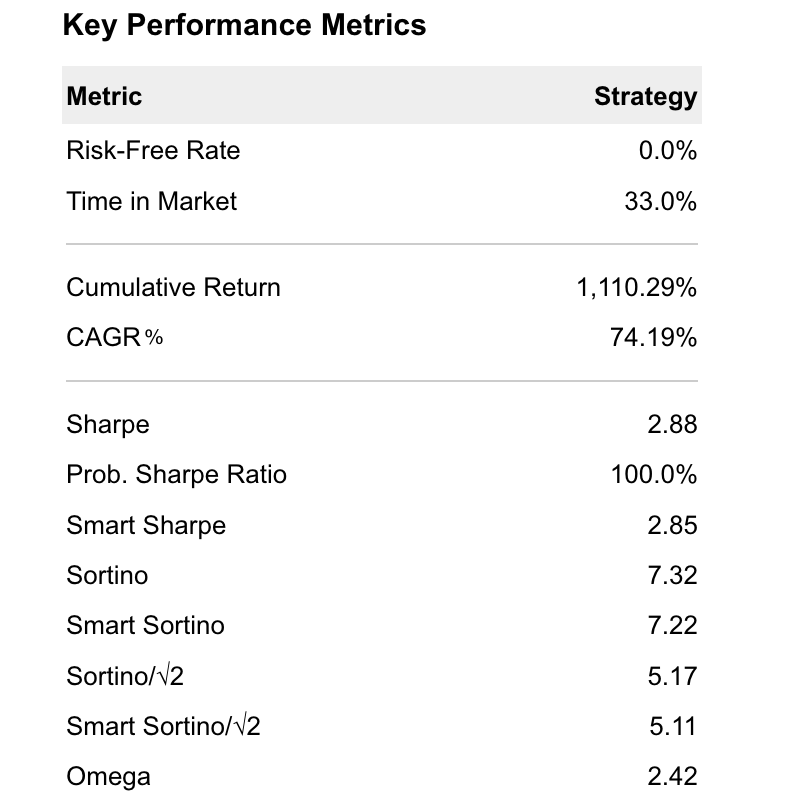

Are These Numbers Real? Let’s Talk Data

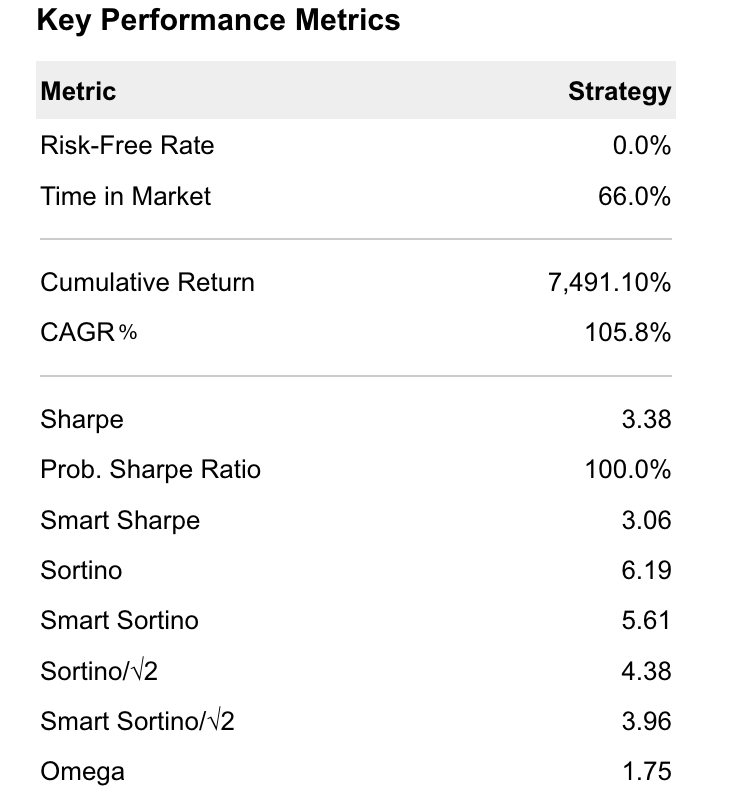

Naturally, 800% yearly returns raise eyebrows. So let’s clarify: these figures are backed by third-party tools like QuantStats, which track and visualize core metrics from real trading data.

Key Metrics We Track:

- Cumulative PnL

- Max and average drawdowns

- Volatility and exposure

- Monthly and annualized returns

- Sharpe & Calmar ratios

- Full trade history

You can request these PDF reports before subscribing. All data is real, timestamped, and validated.

What Strategies Are Available?

We operate in baskets — portfolios of multiple algorithms with complementary logic. This increases strategy robustness and reduces dependence on a single signal.

Examples:

Aquila 50

- Focus: short-term trends and mean-reversion

- Avg. Annual Return: ~105%

- Volatility: up to 31%

- Trades/month: up to 40

- Holding period: up to 3 days

Aquila 70

- Focus: momentum + volatility filtering

- Avg. Annual Return: ~110%

- Sharpe Ratio: up to 3.7

- High scalability and consistency

Aquila Reverse

- Focus: reversal signals post-extreme moves

- Anti-trend model with aggressive capital protection

- Avg. Annual Return: up to 283.8%

- Max drawdown: never exceeded 25%

All baskets trade only BTC/USDT and ETH/USDT — ensuring high liquidity and minimal slippage.

Who Can Access These Private Strategies?

Because the strategies are sensitive to capital size and volatility, access is limited to verified users.

Access Tiers:

Retail Investors (From $5,000)

- Simple CopyTrading connection via private link

- Full control from your own exchange account

- Ideal for non-technical users and first-time investors

Professional Investors (From $100,000)

- API-based connection

- Customizable IP whitelists, risk limits, and trading pair restrictions

- Designed for precision and speed

Security: How Capital is Protected

Our core principle: you never send funds to anyone. Instead:

- You generate your own API keys

- You define trading permissions (no withdrawal rights)

- You whitelist specific IPs and trading pairs

- All trades happen within your own exchange interface

Additionally, we sign a clear agreement with each client, outlining:

- Strategy logic and risk parameters

- Access method (CopyTrading or API)

- Compensation model (e.g., High-Water Mark)

- Investor control rights and revocation policy

You stay fully in charge.

Legal & Technical Framework

Unlike traditional asset managers, we do not manage your capital. This model is structured as a technical subscription service, not financial management. It eliminates most regulatory and legal risks.

Each connection is secured with:

- IP filtering

- Trade-pair restrictions

- 2FA security

- Read-only API without withdrawal rights

- QuantStats transparency and audit trail

FAQ

How long is the subscription?

Typically monthly or quarterly, with optional auto-renewal.

Can I switch strategies?

Yes — at the end of the subscription or on request.

What are realistic returns?

Historical range: 147% to 412% annually. Peaks of 800% occurred during strong bull markets with compounding.

Are there extra fees?

Some strategies include a performance fee based on High-Water Mark. Terms are clear and agreed upon beforehand.

What if the market crashes?

The algorithm stops trading in high-risk environments and always uses stop-losses. You can exit anytime.

Final Thoughts: Who Is This Model For?

Private algorithmic strategies aren’t magic buttons — they’re engineered systems built for professionals. They combine speed, precision, risk control, and automation — and they’re now available via subscription.

With Aquila Private, you get:

✅ Full control over your capital

✅ Institutional-grade strategies

✅ Verified performance analytics

✅ Flexible access with no asset transfer

If you want to invest in crypto with confidence, security, and transparency — this model was built for you.