Introduction: Algorithmic Trading in Crypto

Algorithmic trading is a modern, technology-driven method of executing trades using pre-programmed strategies. These algorithms are designed by experienced professionals and operate autonomously, scanning market data in real time and executing trades with speed and precision.

In the world of crypto, algorithmic trading is especially relevant. With 24/7 market activity, high volatility, and constant price swings, only an algorithm can consistently react fast enough — without emotional bias.

An effective trading algorithm doesn’t just capitalize on micro-movements; it also protects capital during downturns. It operates according to a strict set of rules, immune to human error and emotions.

The Risk of Traditional Crypto Investments

Most crypto investment schemes require transferring your assets to a third party — whether it’s a fund, a trader, or a DeFi protocol. This comes with a number of critical risks:

- Loss of control over your funds

- No real-time transparency

- No legal protection or recourse

- Exposure to mismanagement or fraud

Thousands of investors have already suffered from opaque crypto schemes. The market clearly needs a model where investors remain in full control of their capital throughout the investment process.

A Safer Alternative: CopyTrading and API Integration

CopyTrading and API-based connections offer a fundamentally safer model. Your funds stay on your own exchange account, while the connected strategy trades on your behalf — automatically, and without access to your assets.

How CopyTrading Works

On major exchanges like Binance, OKX, and Bybit, CopyTrading allows investors to subscribe to a strategy via a private link. Once connected, every trade executed by the strategy is mirrored directly on the investor’s account — without the need for software or coding skills.

Key advantages:

- Easy connection process — no technical skills needed

- No external software installations

- Full visibility of all trades within your exchange interface

What is API-Based Trading?

For investors with capital starting at $100,000, API integration offers a more professional-grade connection. The investor generates API keys on their exchange, whitelists specific IP addresses, and defines permitted trading pairs. The strategy then connects directly via the API.

Benefits include:

- Ultra-fast execution with minimal slippage

- Maximum security with IP whitelisting and trade-pair restrictions

- Complete isolation from withdrawal permissions or external interference

This is the standard used by institutional investors who need precision and scalability without compromising security.

How to Invest Without Handing Over Your Crypto

The golden rule: your funds always stay with you. To start investing with Aquila Private strategies:

- Register on the platform

- Choose a strategy and subscribe

- Receive a private CopyTrading link or API setup instructions

- Connect your account via your exchange

This method removes the risk of losing assets to external platforms. All trades happen within your own exchange — which you already trust.

Why It’s Safer to Trade from Your Own Exchange Account

CopyTrading and API integration are built around one idea: the investor should never give up control.

Security Features in API Connections

- IP whitelisting — Only specific, pre-approved IPs can trade on your behalf

- Trading pair restrictions — Limit trading to high-liquidity pairs like BTC/USDT and ETH/USDT

- No withdrawal access — API permissions don’t include fund transfers

If needed, you can disable or delete the API key at any time — instantly and independently.

CopyTrading Is Just as Flexible

CopyTrading links can be disconnected at any time with no delay, no approval needed, and no third-party intervention. This makes it ideal for private investors who value flexibility and capital protection.

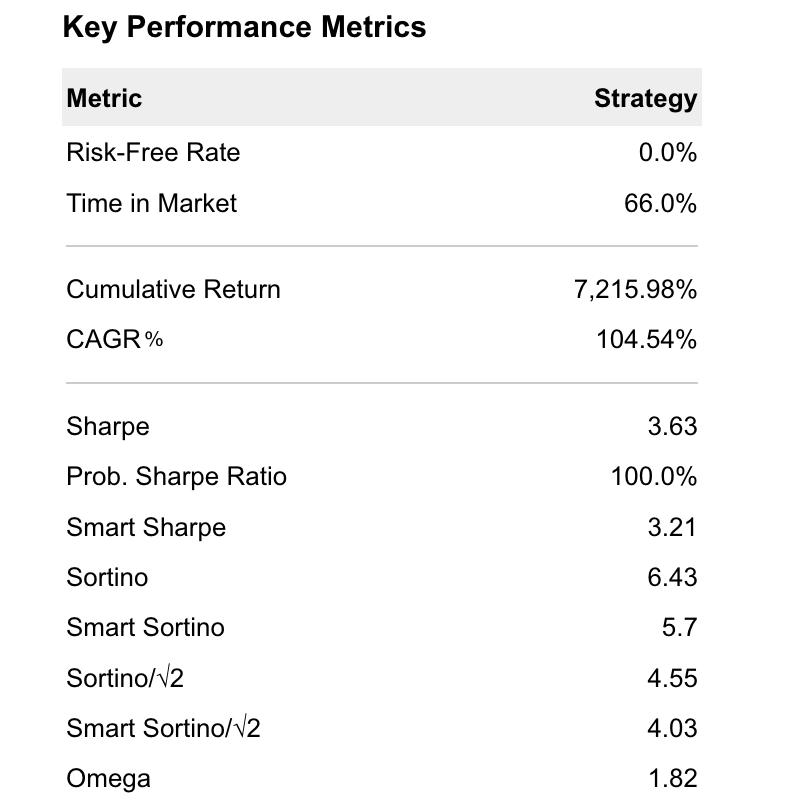

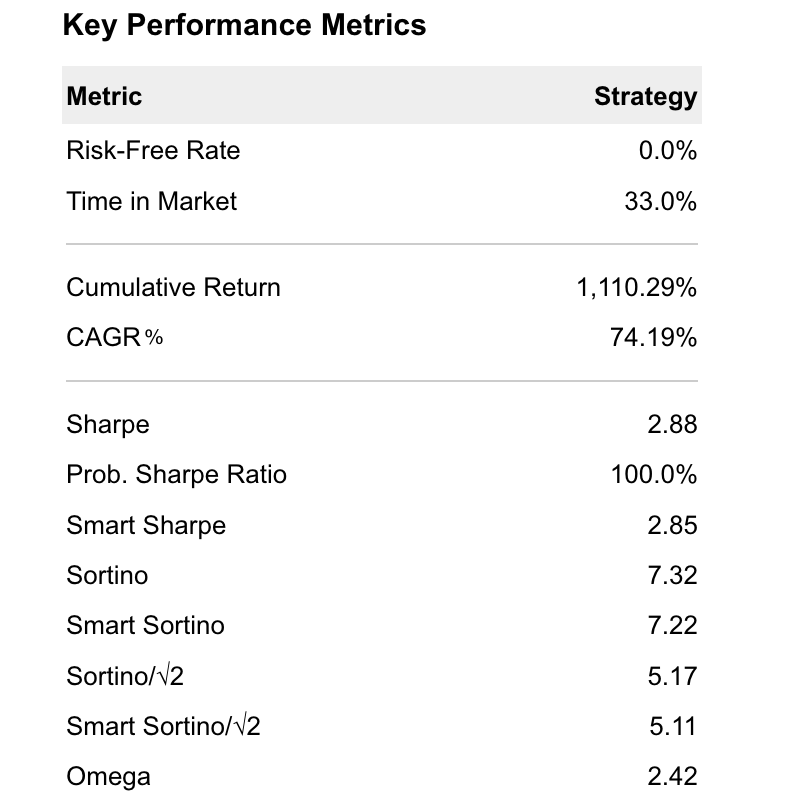

Verified Trading History and Results

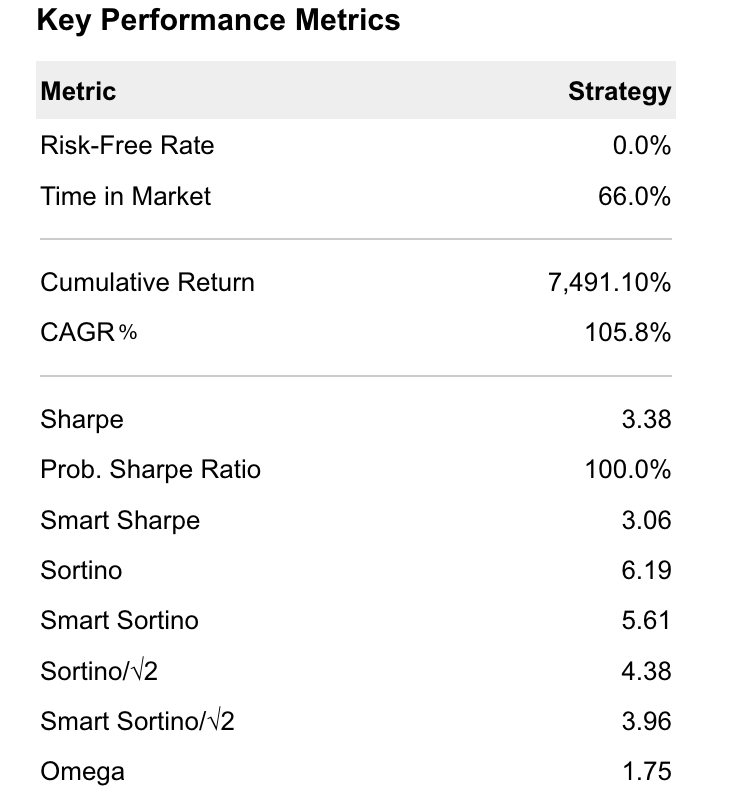

Aquila Private provides full performance analytics for each strategy using QuantStats — an institutional-grade tracking system that covers:

- Daily and monthly PnL

- Max drawdowns and recovery periods

- Win/loss ratio

- Annualized returns

- Sharpe, Sortino, and Calmar ratios

- Trade frequency and exposure

Example Results

- Annual return: 147% to 412% depending on the strategy

- Max drawdown: up to 24.61%

- Sharpe ratio: up to 5.9

- Up to 45 trades per month

- Time in market: up to 84%

All data is backed by live trading, backtesting, and forward testing on major exchanges — from 2019 to today.

Investor Case Studies

Clients who allocated $100,000 in early 2023 reached over $1 million by mid-2025 — based on compound performance and real-time execution. These investors kept their funds in their own accounts at all times and could disconnect the strategy at will.

Who Is This Investment Model For?

This approach suits three core groups:

1. Individual Investors ($5,000+)

Retail investors can enter the market safely via CopyTrading — without needing advanced knowledge. Subscription-based access means no setup headaches and full control.

2. Institutional Investors ($100,000+)

Larger investors benefit from professional-grade API access, fast execution, scalable strategy deployment, and tight control over security parameters.

3. Investors Who Value Control

If you’ve ever lost money to a crypto fund, you know how important control is. Keeping your assets on your own account eliminates this psychological barrier — and the real financial risk.

Comparing With Traditional Asset Management

| Traditional Model | Aquila Private Model |

|---|---|

| Funds are transferred to third party | Funds stay in your own account |

| Investor loses control | Investor has full control |

| Trade data is often hidden | Full transparency via exchange |

| No legal protection | No asset transfer = no legal risk |

| Risk of exit scams | Strategy can be paused anytime |

This is the future of smart investing — built for safety, speed, and full transparency.

Legal and Technical Safety

There is no capital transfer involved. You’re subscribing to a technical service that gives you access to a strategy — not handing over your assets. The agreement includes:

- Strategy parameters

- Method of connection (CopyTrading or API)

- High-Water Mark (HWM) logic

- Subscription and performance fee terms

- Conditions for disconnecting or modifying access

This structure is regulatory-friendly and eliminates common legal pitfalls.

On the tech side, all connections are secured via:

- IP filters

- Pair limitations

- Read-only API access (no withdrawals)

- Two-factor authentication

- Transparent trade logging via your exchange

Getting Started: From Signup to Execution

1. Create Your Account

Register on Aquila Private. Browse the available strategies, view past performance, and choose the one that fits your goals.

2. Subscribe to a Strategy

Pay the subscription fee to unlock access to the CopyTrading link or API instructions.

3. Connect Your Exchange

Follow simple steps to connect your Binance, Bybit, or OKX account. No third-party software is required.

4. Monitor and Manage

Once connected, the strategy begins trading. You can:

- View live trades

- Track your PnL

- Check historical stats

- Pause or stop at any time

Frequently Asked Questions

Can I switch strategies later?

Yes, you can change at the end of the billing period or by request.

What if the exchange goes down?

Trading pauses automatically. The algorithm is coded to stop during outages.

Is there a performance fee?

If applicable, it’s based on High-Water Mark — you don’t pay unless you reach new profit highs.

How do I know the data is real?

All stats are from QuantStats and reflect live trading on actual exchanges.

What if I need help?

Aquila Private offers full support via Telegram, email, and in-dashboard chat.

Final Thoughts

Investing in crypto doesn’t have to mean losing control. With Aquila Private, you retain ownership of your assets, benefit from high-performing strategies, and stay in charge — every step of the way.

✅ No capital transfer

✅ Verified strategy performance

✅ Real-time trade transparency

✅ Instant disconnect anytime

If you’re looking for a modern way to grow your capital — without handing it over — algorithmic trading via CopyTrading or API may be your smartest move yet.